July 02, 2025 12:39AM

What Really Drives Skincare Purchases in Malaysia: A Look Beneath the Surface

Skincare choices in Malaysia are shaped by more than just what’s trending. For many consumers, it is about managing real, everyday concerns like sensitive skin, humidity, or breakouts, while also balancing price, trust in a brand, and the need to feel good in their own skin. Effectiveness still matters, but so do other things like clean ingredients, how a product feels, and whether it fits into a daily routine or a special occasion.

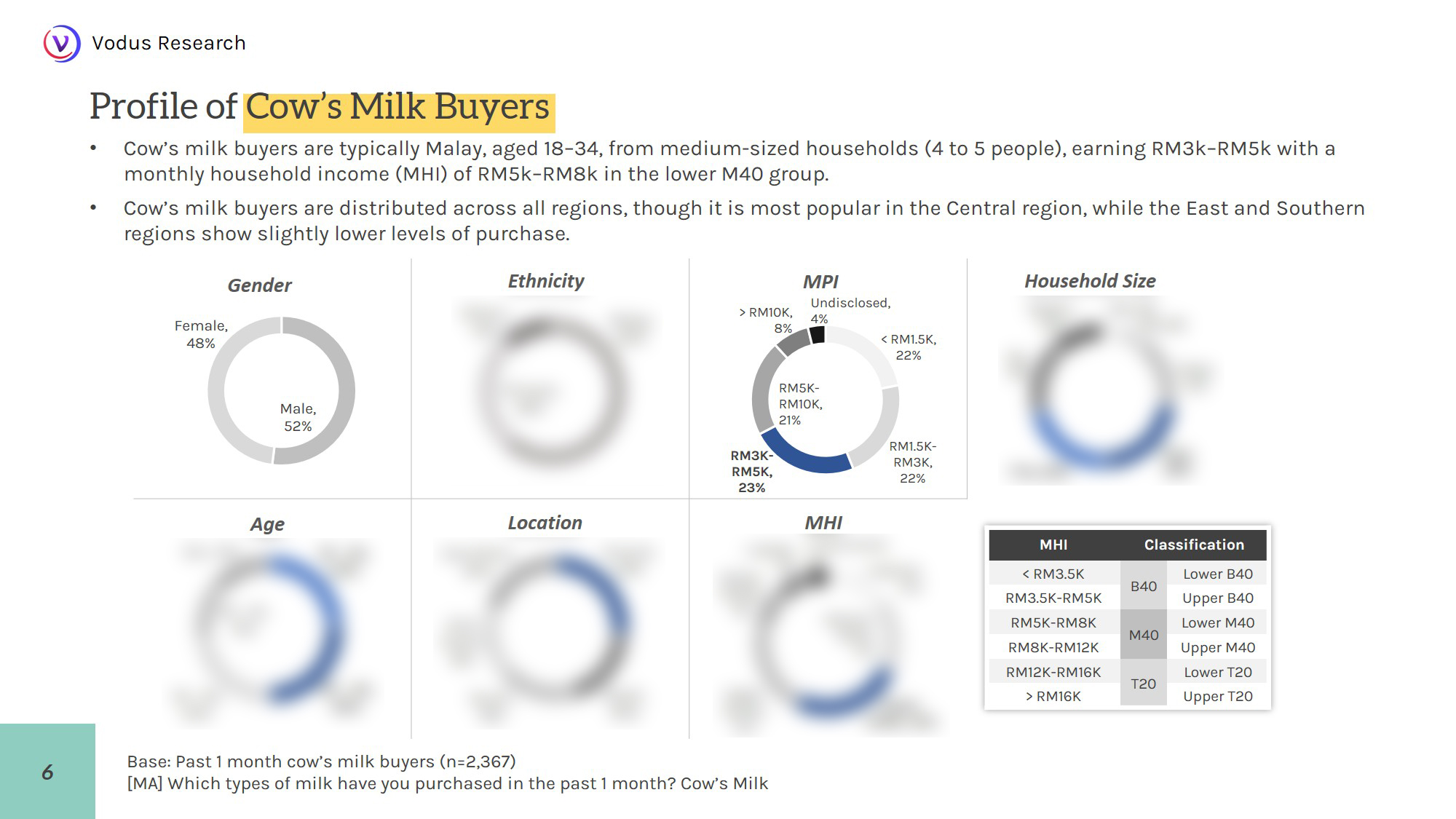

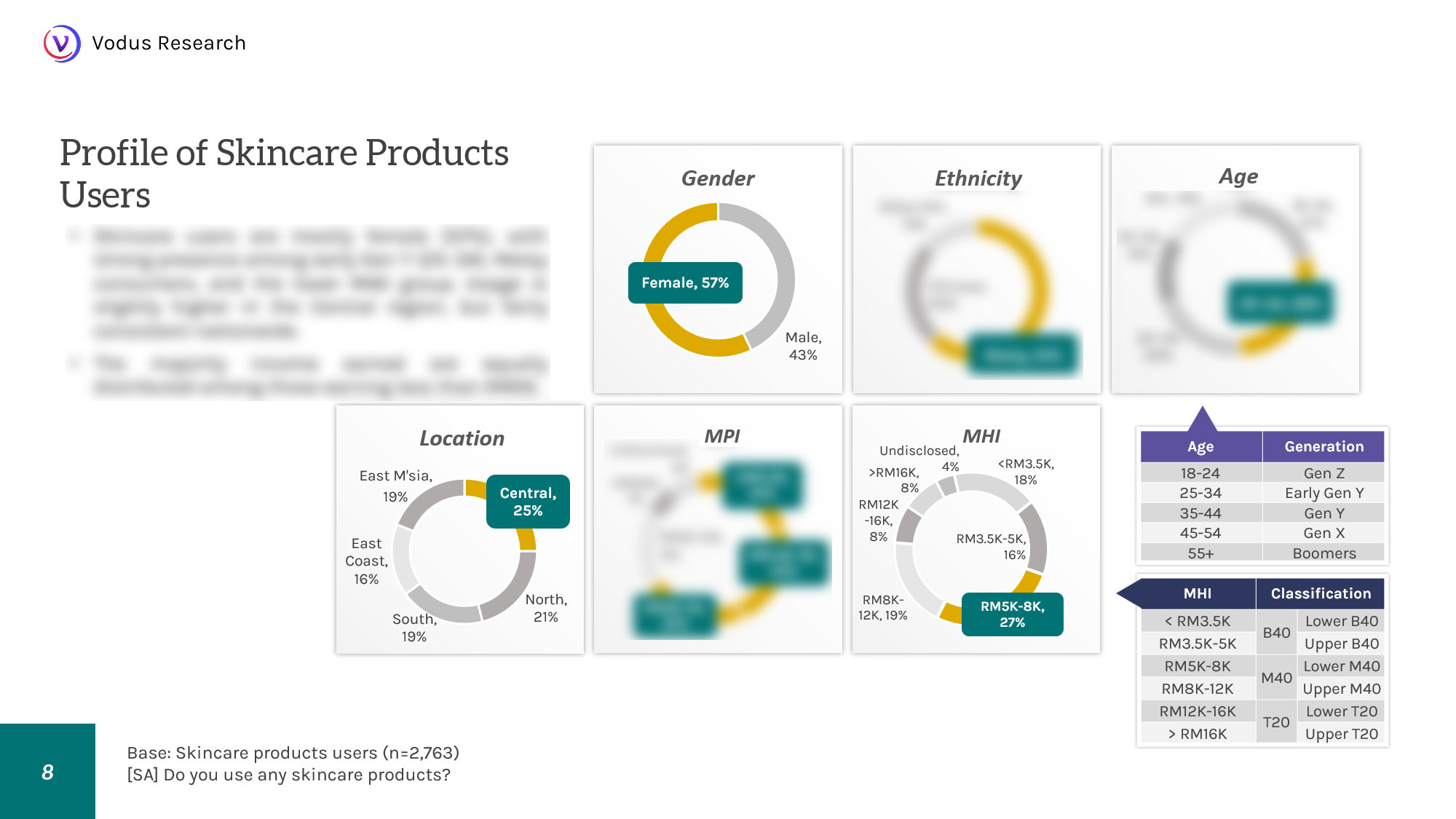

To better understand what truly drives these decisions, we carried out a nationwide survey looking at not just what people are using, but why they choose certain brands, what makes them curious enough to try something new, and what inspires them to spend more on products that feel more personal or premium. We also explored how these preferences shift across different groups, including gender, age, and how often someone uses skincare.

Do younger Malaysians really care more about ingredients? Are men more focused on price than women? What pushes someone to stay loyal to a product, and what encourages them to explore?

This article takes a closer look at the personal, practical, and emotional reasons behind skincare choices in Malaysia. The findings reveal what matters most to consumers, what they wish brands understood better, and the small details that can make a big difference.

Research Methodology

To uncover these insights, Vodus Research conducted a nationwide online survey Skincare Market Report Malaysia 2025 involving over 1,000 Malaysian respondents across both Peninsular and East Malaysia. Data was collected through the Vodus Media Network, which includes high-traffic digital platforms such as Astro, Media Prima, and Star Media Group.

The survey captured a diverse mix of skincare users across different demographics, including age, gender, and frequency of skincare use—from occasional buyers to committed daily users. This allowed for deeper segmentation and comparison of purchase drivers across different consumer groups, offering a clearer view of the values, expectations, and decision-making patterns that shape skincare purchases in Malaysia.

What Malaysians Are Really Looking for in Skincare Products

When it comes to skincare, most Malaysians are looking for products that do more than just feel good on the skin. There is a clear focus on both prevention and ongoing care. Right at the top of the list are oil control and anti-aging benefits. These two concerns are especially relevant in a hot and humid climate, where oily skin and early signs of ageing are common challenges.

Oil control stands out among specific groups. It tends to be more important to men and to Gen Y consumers, particularly those earning between RM5k and RM10k a month. It also appeals strongly to those with oily skin, people who regularly use exfoliators, and those who take a more invested approach to skincare. These are the consumers who see themselves as skincare enthusiasts and often look for products backed by scientific evidence. For them, oil control is not just a nice feature. It is essential to how they manage their skin.

Anti-aging, on the other hand, finds strong appeal among women, especially those in Gen Y, Gen X, and Boomer age groups. It also resonates with individuals who have combination skin, use toners and exfoliators, and consider themselves skincare enthusiasts. Many in this group embrace what could be described as an age-defying mindset, where skincare is about maintaining confidence and long-term results rather than just treating visible concerns.

Beyond oil control and anti-aging, many Malaysians also prioritise sun protection, brightening, acne control, and hydration. These choices reflect everyday concerns such as UV exposure, uneven skin tone, breakouts, and dryness. These are common issues that cut across different age groups, skin types, and routines.

For brands, the takeaway is clear. Products that target oil control and anti-aging are likely to attract broad interest. At the same time, multi-benefit products that combine popular features such as hydration and brightening, or acne care with sun protection, are especially well-positioned to meet the needs of today’s Malaysian skincare consumers.

Want deeper insights into which benefits matter most to specific segments? The full report breaks down preferences by age, gender, income, and more.

Download the full report to explore the data.

What Makes a Skincare Brand Worth Buying

With so many skincare options on the market, what actually makes someone pick one brand over another? For many Malaysians, the answer starts with affordability. Price is the most important factor in the decision-making process, especially among consumers who describe themselves as budget-conscious or minimalist. This is particularly true for those earning between RM3,000 and RM5,000 a month, as well as among Chinese consumers and those living in the Northern region. Many in this group also have oily skin and include exfoliators in their routines. For them, a good product is one that works without breaking the bank.

But affordability alone isn’t enough. The way a product is formulated—what’s inside the bottle—also plays a big role. Skincare enthusiasts, especially those in Gen Y, often look closely at the ingredients before making a choice. Many are drawn to clean beauty principles or have an age-defying mindset that prioritises long-term skin health. This group tends to live in more urban areas like the Central region, earns between RM3k and RM10k a month, and often has combination skin. For them, formulation is not just about results but about trust and transparency.

Brand reputation also carries weight, particularly when consumers are deciding between two seemingly similar products. A trusted name can tip the balance, especially when the brand has built credibility over time.

Beyond these core factors, other elements influence the final decision. About two in five consumers say they pay attention to Halal certification and rely on recommendations from people they trust respectively—whether that’s friends, family, or influencers they follow online. Packaging and product availability matter too, though to a lesser extent. For around one in five shoppers, the way a product looks and how easy it is to find it can still sway the purchase.

Want to understand how different users weigh each factor?

Get the full report to explore how affordability, ingredients, and reputation influence different consumer groups.

More Than Just Price: The Role of Budget, Trust, and Value

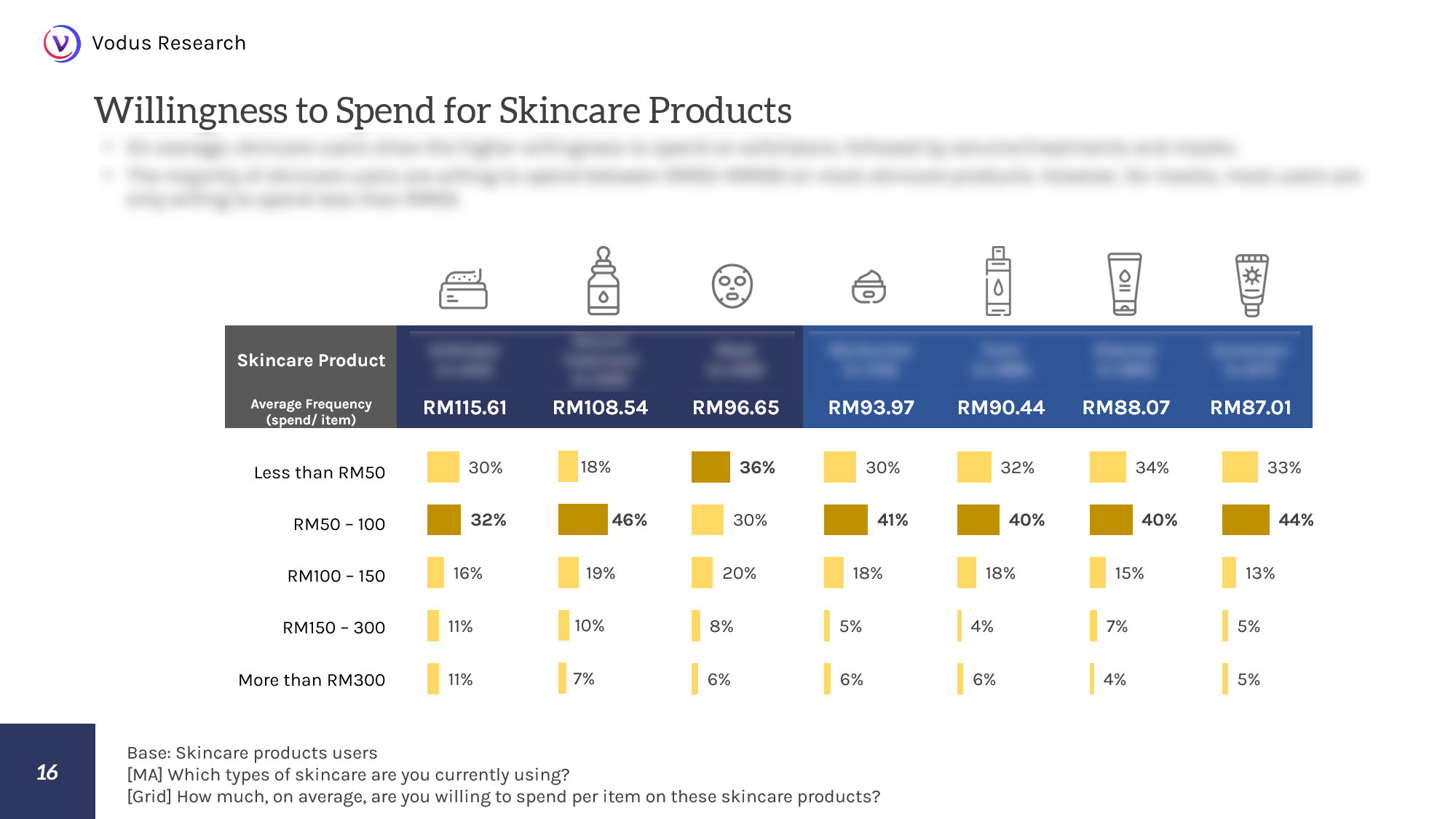

For many Malaysians, skincare is an investment — but how much they’re willing to spend depends on the product, the promise it makes, and how personal the experience feels. While affordability remains a core consideration, most consumers are not just chasing the lowest price. Instead, they’re looking for value: a product that feels worth it, whether because of how well it works or how well it fits into their routine.

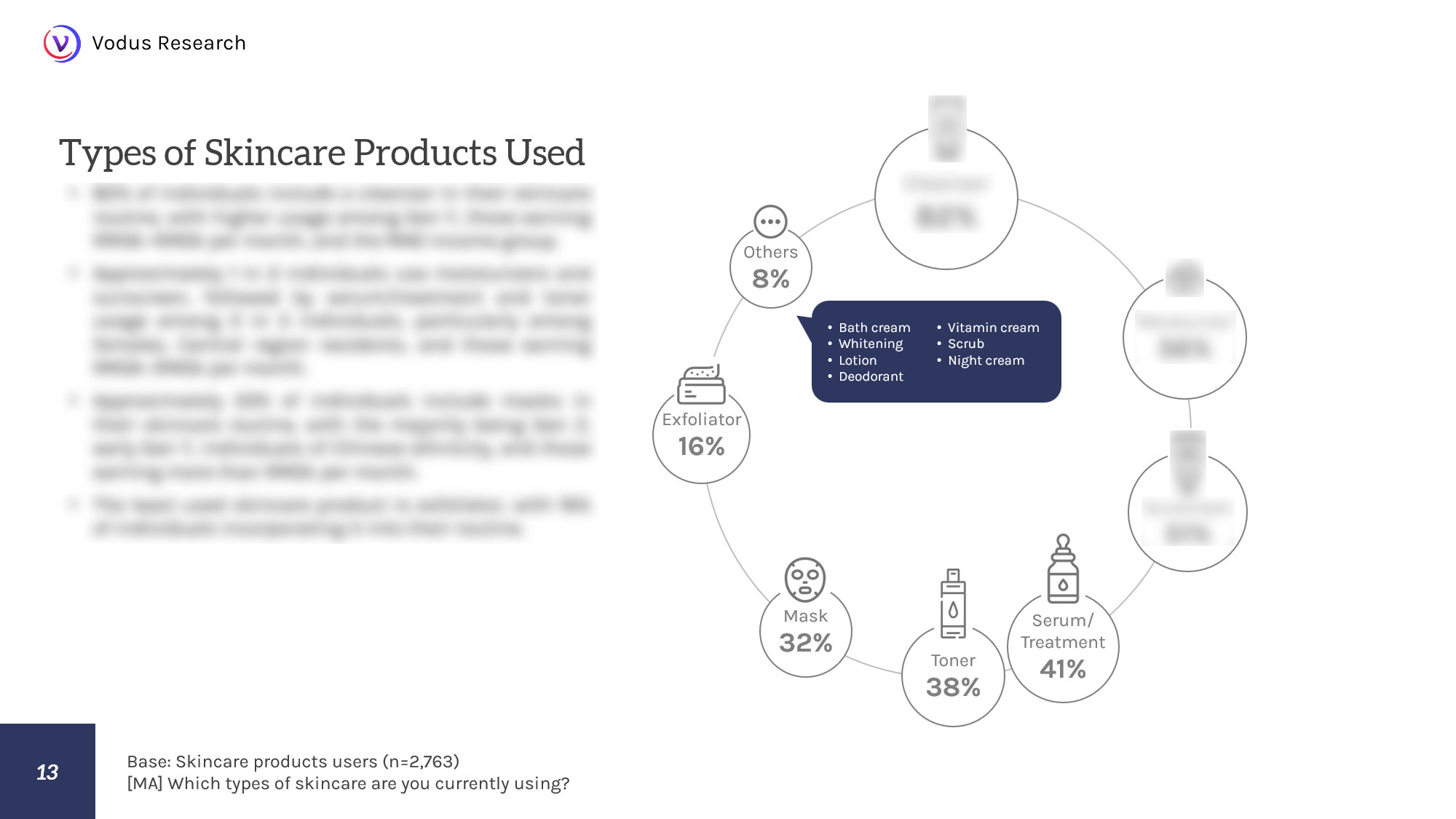

Across the board, the sweet spot for skincare spending falls between RM50 and RM100 for most product types. This is the range where consumers feel they’re getting reliable quality without going overboard. That said, not all categories are seen in the same way. Users are most willing to spend more on exfoliators, followed closely by serums and treatments—items often seen as high-impact or targeted solutions. Masks, on the other hand, tend to sit on the lower end of the spending scale, with most consumers preferring to keep those purchases under RM50.

What’s interesting is that willingness to spend doesn’t just come from product type—it’s also shaped by the user’s mindset. Skincare enthusiasts and those who follow clean beauty principles are often more open to paying a premium, especially when the product feels tailored to their needs. This is particularly true among users with sensitive skin, those earning more than RM3,000 a month, and individuals from the East Coast. For these consumers, personalization isn’t just a luxury—it’s a reason to spend more, as it signals that the brand understands their skin on a deeper level.

Curious about who’s spending more — and on what?

Get the full report for spending behaviours across product types, price ranges, and consumer personas.

When People Switch: What Sparks Trial and What Builds Loyalty

Skincare routines may be personal, but they’re not always permanent. Many Malaysians are open to trying new products — though not for the reasons you might expect. It’s not flashy ads or new launches that spark the most curiosity. Instead, the real motivators are much more grounded: trust, credibility, and social proof.

The top driver? Word of mouth — or more accurately, the digital version of it. Two in five consumers say positive consumer reviews are what pushes them to try a new skincare product. This shows how much weight people place on the lived experiences of others who’ve used a product and had results. Right behind that are expert reviews, suggesting that while peer influence is strong, advice from dermatologists, beauty advisors or well-known skincare professionals still carries authority.

Promotions and freebies also play a role, though to a lesser degree. About 14 percent of consumers say discounts catch their attention, while another 11 percent are swayed by free samples. These incentives are especially effective among lower-income consumers, particularly those earning RM1,500 a month or less. For these users, trying something new often comes down to whether it feels like a low-risk decision — either financially or in terms of skin reaction.

Interestingly, new product launches barely move the needle. Only a low number of respondents say newness alone is enough to make them try a product. In other words, Malaysians don’t necessarily chase what’s latest — they chase what’s trusted, proven, or personally recommended.

Need to know what truly drives trial and loyalty in Malaysia?

Download the full report for an in-depth look at switching behaviours and brand stickiness.

The Skincare Mindset: Practical, Personal, or Emotional?

Skincare may start at the surface, but for many Malaysians, it goes much deeper. Whether it’s about managing a skin concern, feeling more confident, or simply enjoying a daily ritual, people approach skincare in ways that reflect their personality, lifestyle, and values.

For many consumers, skincare is first and foremost about maintaining healthy skin. Around 80 percent say they prioritise products that enhance skin health, a view especially common among Boomers and those in higher-income brackets. For this group, skincare is less about trends and more about longevity — a practical, results-driven approach shaped by experience and long-term thinking.

But not all motivations are purely functional. For some, skincare is also a form of self-expression or self-care. Half of all consumers say they enjoy experimenting with new products and ingredients, with early Gen Y leading the way. Trying out a new serum or switching up a routine isn’t just about better skin — it’s about discovery, curiosity, and sometimes, the joy of treating oneself.

Many users are also guided by a desire for simplicity and trust. Three-quarters of consumers prefer using products tailored to their specific skin type and often stick to the same brand across their routine. This loyalty reflects a comfort with familiarity — once they find something that works, they’re reluctant to change it. This mindset is especially common among those with sensitive or dry skin, who often see skincare as protective and essential, rather than optional.

Meanwhile, consumers with normal or oily skin tend to fall into more enthusiastic or exploratory categories. Those with normal skin are more likely to identify as skincare enthusiasts or clean beauty followers. Combination skin users, on the other hand, lean toward natural, ingredient-focused choices — reflecting a mindset that balances results with gentleness.

Want to tap into these skincare mindsets?

The full report reveals five dominant consumer personas and how they shape brand decisions.

What Brands Should Understand Better

Behind every skincare purchase is a mix of emotions, habits, and practical needs. For Malaysian consumers, it is not just about what is new or trending. It is about what works, what feels right, and what fits into their personal definition of care. Whether it is choosing a product for its ingredients, affordability, or the trust it inspires, people are thoughtful in how they build their routines.

What does this mean for brands? It is time to move beyond surface-level claims. Consumers are making it clear that they want brands to truly understand their skin, align with their values, and provide a balance of reliability and fresh thinking. The more a brand can demonstrate this understanding through its products, communication, and overall experience, the stronger the connection it can create.

Curious how Malaysians shop for skincare? Read the article: How Malaysians Buy Skincare: Mapping the Path to Purchase for insights into what influences their choices and shopping channels.