July 21, 2025 12:39AM

How Malaysians Buy Skincare: Mapping the Path to Purchase

Malaysian consumers are navigating a more complex skincare landscape than ever before. They are discovering products through influencers, social media, in-store advisors, and online reviews. Purchases are then made across a wide mix of channels, including pharmacies, e-commerce platforms, beauty outlets, and smaller specialist stores. The journey from interest to purchase is rarely straightforward, and the channels consumers trust often play a bigger role than the brands themselves.

To better understand this evolving landscape, Vodus Research surveyed over 1,000 Malaysians across Peninsular and East Malaysia. The findings offer a window into how consumers move from product discovery to purchase, and what influences their choice of shopping channels along the way.

For marketers, brand owners, and retailers, these insights reveal not just where consumers are shopping, but how they are being influenced before they ever reach the checkout. In a market where visibility, convenience, and trust all shape behaviour, knowing what drives these decisions is key to building effective channel and communication strategies.

Methodology

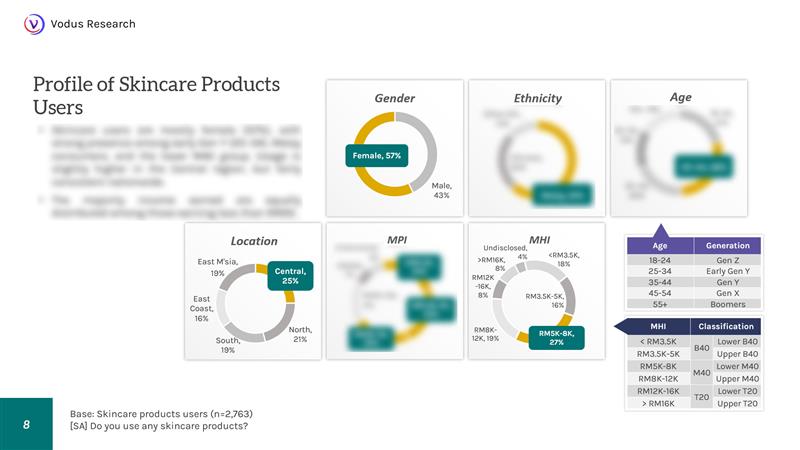

This article is based on a nationwide online survey conducted by Vodus Research with over 1,000 Malaysian respondents across both Peninsular and East Malaysia. The sample includes a diverse representation of age groups, income levels, ethnicities, and skincare usage profiles to ensure balanced and reliable insights into consumer behaviour.

The findings offer a detailed view of how Malaysians shop for skincare, what influences their product choices, and how these patterns vary across different consumer segments.

Where Malaysians Buy Skincare

Pharmacies remain the leading channel for skincare purchases in Malaysia. Nearly two in three consumers report buying skincare from pharmacies, making them the most frequently used retail format. Their widespread availability, familiar product range, and reputation for trust and accessibility keep them at the centre of the skincare shopping experience.

Online stores also account for a significant share of skincare purchases. Around half of consumers report buying skincare through platforms such as Shopee, Lazada, and other large e-commerce sites. These marketplaces are especially popular among Gen Y consumers, who tend to value convenience, broader product variety, and frequent promotions available on these platforms.

Product agents continue to serve a notable portion of the market as well, with around one in six consumers purchasing skincare through direct sellers. This channel offers a more personalised approach and remains relevant in communities where peer recommendations and trusted intermediaries play a strong role.

Traditional retail formats such as supermarkets, beauty outlets, and brand-specific stores continue to attract a meaningful share of skincare buyers. These channels provide an opportunity for in-person browsing and direct product comparison, which remain important to certain consumers.

Smaller but still relevant segments of consumers purchase through brand websites, beauty clinics, or platforms like TikTok Shop. While these channels serve a narrower group, they reflect the continued diversification of the skincare retail landscape and the growing role of community-led and content-driven selling models.

What emerges is a picture of a highly fragmented market. Rather than shifting entirely toward one channel, consumers are choosing based on context, need, and influence. This has important implications for brands. To remain competitive, skincare companies must ensure a consistent presence across both mainstream and emerging channels, while tailoring their retail strategies to match shopper expectations at each touchpoint.

For a full breakdown of purchase channels by age, region, income group, and skin type, download the complete report.

How Malaysians Discover Skincare Products

Skincare discovery often begins well before a product reaches a shopping cart. In Malaysia, social media is the most commonly used source of information. Platforms such as TikTok, Instagram, and YouTube are especially popular among Malay consumers and budget-conscious shoppers. These channels do more than create awareness. They shape preferences, highlight trends, and influence everyday skincare routines.

Friends and family are also a major source of skincare recommendations. For many consumers, word-of-mouth carries more credibility than brand-led content. Dermatologists and skin care professionals are another important group, particularly among those with sensitive skin or more complex concerns.

Around one in three consumers refer to in-store beauty consultants, brand websites, or skincare influencers when researching products. These sources provide a mix of personal experience and technical knowledge, which helps guide product selection and build confidence before purchase.

Advertisements are the least relied upon overall, but they continue to have more impact among Gen Y, Gen X, and skincare enthusiasts. While ads may no longer be the primary source of information, they still play a role in reinforcing awareness and credibility for specific groups.

What stands out is the variety of channels consumers use to inform their decisions. Some prioritise expert advice, while others respond to relatability and shared experience. For skincare brands, being present across these touchpoints is key to building trust and driving conversion.

To see how skincare information sources vary by ethnicity, income level, skin type, and user profiles such as skincare enthusiasts or budget-conscious shoppers, access the full market report for detailed demographic insights.

How Information Sources Influence Where Malaysians Shop

The connection between where consumers discover skincare products and where they choose to buy them offers valuable clues for marketers. While shoppers use a range of information sources, not all of them lead to the same types of stores or platforms.

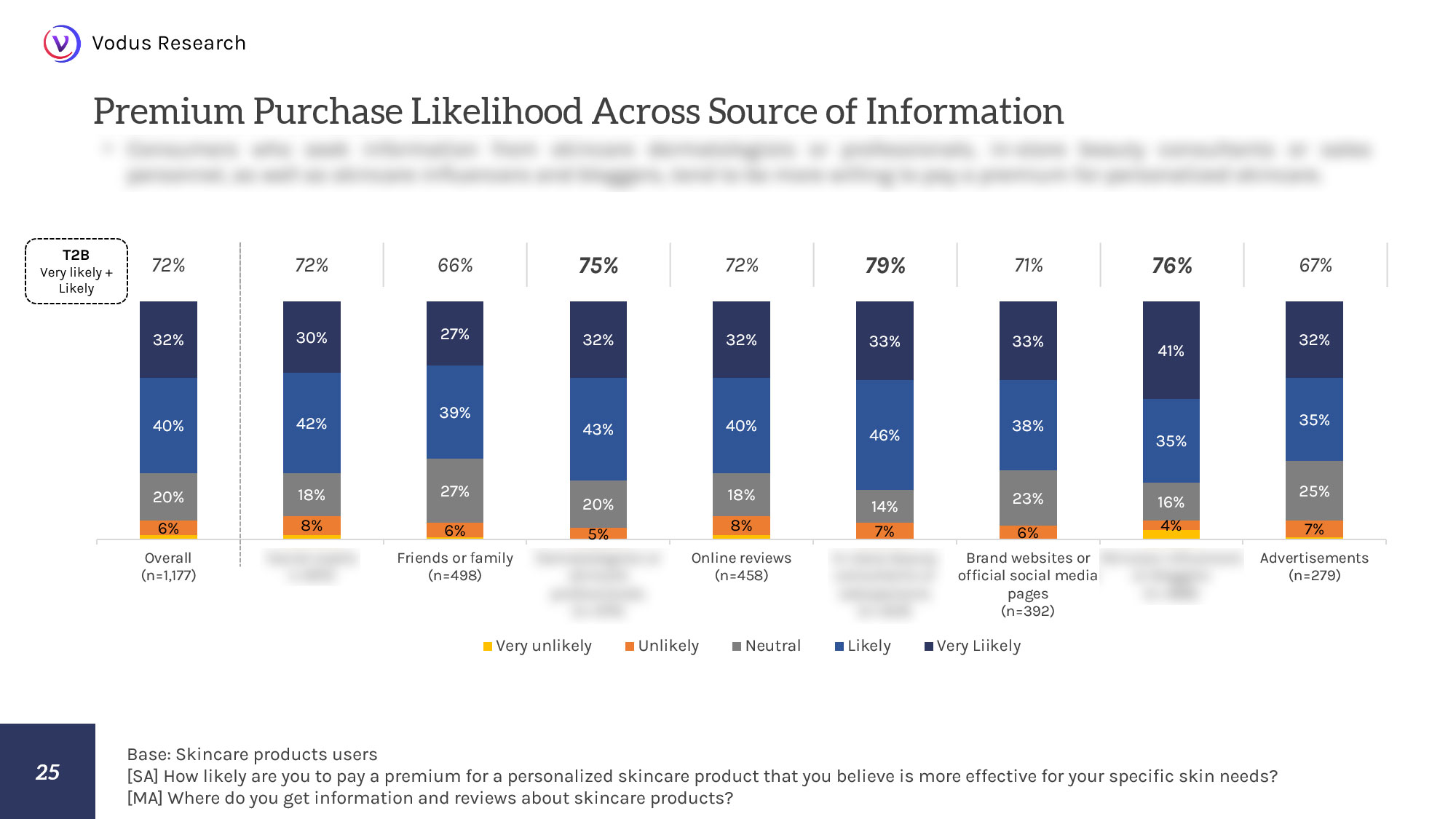

Social media stands out as a key driver of purchases through online stores, beauty retailers, and brand-specific outlets. Over 60 percent of consumers who buy from these channels also rely on platforms like TikTok, Instagram, and YouTube for skincare content and product reviews. This suggests that social-led discovery plays a strong role in shaping not just what people are interested in, but also where they choose to shop.

Pharmacy shoppers, on the other hand, show a very different pattern. They are among the least likely to be influenced by dermatologists, online reviews, in-store beauty consultants, brand websites, skincare influencers, or advertisements. This indicates a more straightforward purchase behaviour, likely driven by routine, convenience, or longstanding trust in physical retail.

Advertisements appear to have limited impact across the board. While they may help build brand familiarity, they are rarely a deciding factor when it comes to making a purchase—regardless of channel.

These patterns show that different touchpoints shape different paths to purchase. Social media tends to drive engagement and action in digital and beauty-focused retail settings, while pharmacy buyers often rely less on outside information altogether. For brands, aligning messaging and media strategy with each channel’s audience is key to turning attention into action.

To explore how information sources influence skincare purchases across different demographics—including age group, ethnicity, income level, and skincare needs—access the full market report for detailed cross-channel insights.

Malaysian consumers are navigating a skincare market shaped by diverse influences and increasingly fragmented shopping behaviours. From pharmacies to online marketplaces, the choice of where to buy is closely tied to how and where consumers first learn about products.

Social media continues to play a central role in driving discovery and purchase, especially among digital-savvy shoppers. Meanwhile, more traditional channels like pharmacies remain strong but tend to serve consumers who rely less on external information sources. The influence of advertising appears limited overall, reinforcing the need for more targeted and trust-based engagement strategies.

For skincare brands, success lies in understanding these connections and tailoring both retail presence and communication to meet consumers where they are—whether online, in-store, or in between. The more aligned a brand is with the shopper’s journey from awareness to checkout, the greater the opportunity to build trust, relevance, and long-term value.