July 24, 2025 9:54AM

Local vs. Global: Which Skincare Brands Are Winning Malaysian Hearts in 2025?

Malaysian skincare consumers are faced with a growing array of choices, from globally recognised names to an increasingly confident wave of homegrown brands. International players may bring global prestige, but on the ground, purchase decisions are often far more nuanced.

Brand awareness doesn’t always lead to purchase, and loyalty hinges on more than just visibility. What makes a consumer choose one brand over another? And how do perceptions of local and global influence those choices?

Drawing from Vodus Research’s national skincare survey, this article explores which brands Malaysians recall most easily, which they are buying, and what influences those decisions. From affordability and trust to identity and efficacy, we examine what truly drives preference in this competitive market.

As part of the survey, consumers were shown a list of local and international skincare brands across a range of segments. These included Bio-essence, Skintific, Cetaphil, Hada Labo, Wardah, Glad2Glow, SimplySiti, Garden of Eden, ALIA, La Roche-Posay, Beauty of Joseon, CeraVe, SomeByMi and Somethinc.

Research Methodology

This article is based on findings from the Skincare Market Report Malaysia 2025 survey conducted by Vodus Research. The study explored consumer awareness, consideration, and brand preference across a wide range of local and international skincare brands in Malaysia.

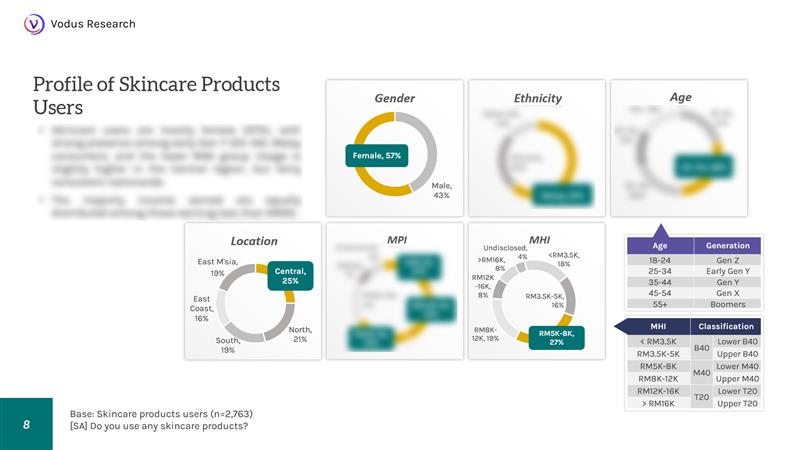

The survey collected responses from over 1,000 Malaysian consumers, spanning various age groups, income levels, ethnic backgrounds, and skincare user types. Respondents were asked about their skincare habits, preferred brands, and perceptions of both local and global players in the market.

Insights were gathered through Vodus Research’s proprietary online survey platform, which reaches millions of Malaysians via the Vodus Media Network. This network includes high-traffic digital publishers such as Astro, Media Prima, and Star Media Group, enabling broad and representative coverage across Peninsular and East Malaysia.

The data offers a comprehensive view of the Malaysian skincare market and consumer sentiment, providing valuable insights for brands and marketers navigating this dynamic category.

Awareness vs. Preference: Not Always the Same Story

When it comes to skincare, being well-known doesn’t always translate into being well-loved. While global brands dominate the conversation in many markets, the Malaysian landscape tells a more layered story.

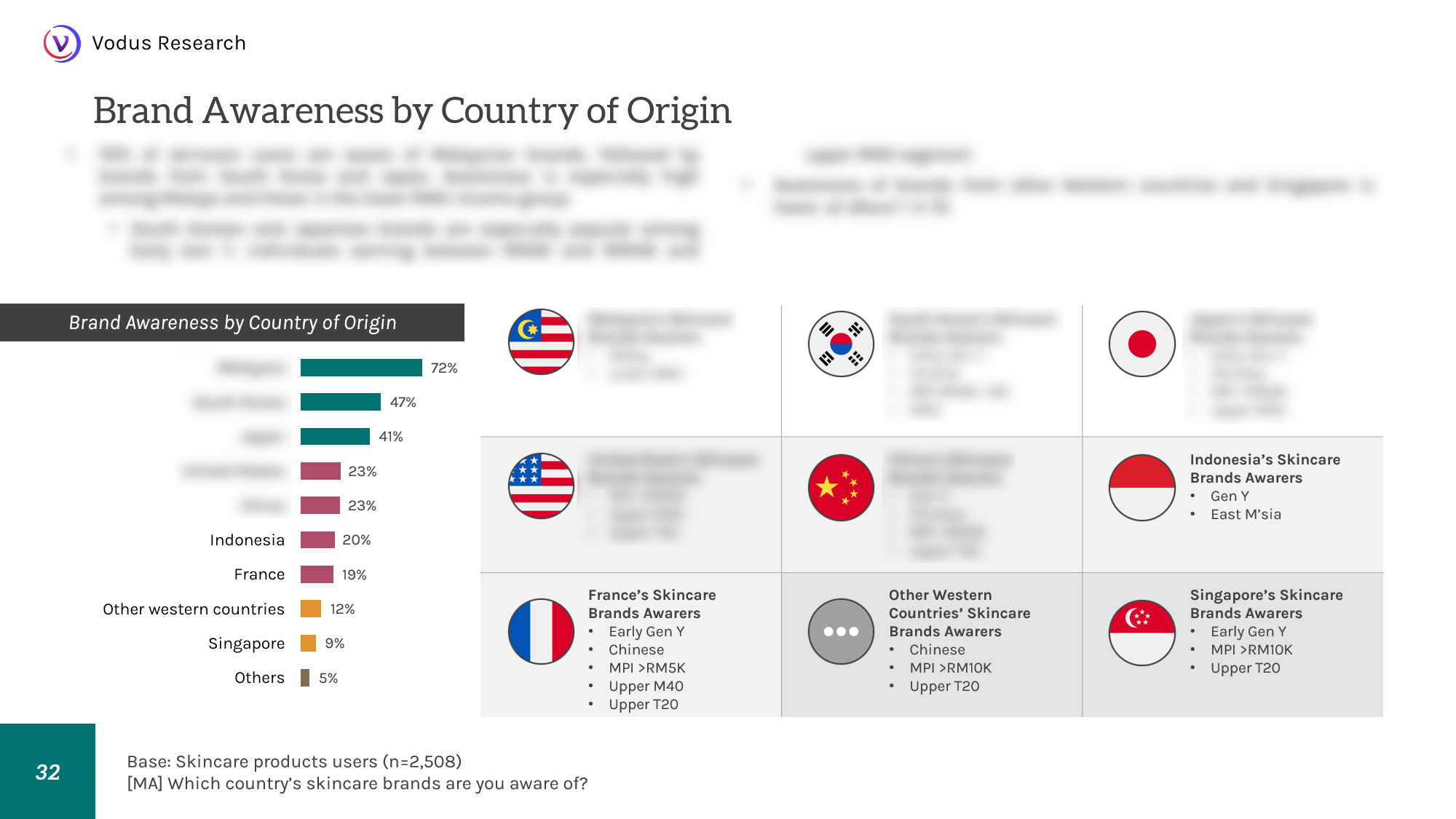

Brands from South Korea and Japan enjoy strong awareness, particularly among younger Malaysians and those in middle to upper income groups. Their popularity has been driven by K-beauty trends, product innovation, and visibility across digital platforms.

But awareness is only part of the equation. While international names are familiar to many, Malaysian skincare brands are gaining deeper traction, especially among specific consumer segments. This shift highlights an important distinction. Consumers may recognise global names, but their actual choices are shaped by more personal factors like suitability, value and cultural relevance.

To explore how brand awareness, consideration and preference differ across age groups, income levels, ethnicities and skincare user types, download the full report for a deeper view into the Malaysian skincare market.

Local vs. Global Brand Perceptions

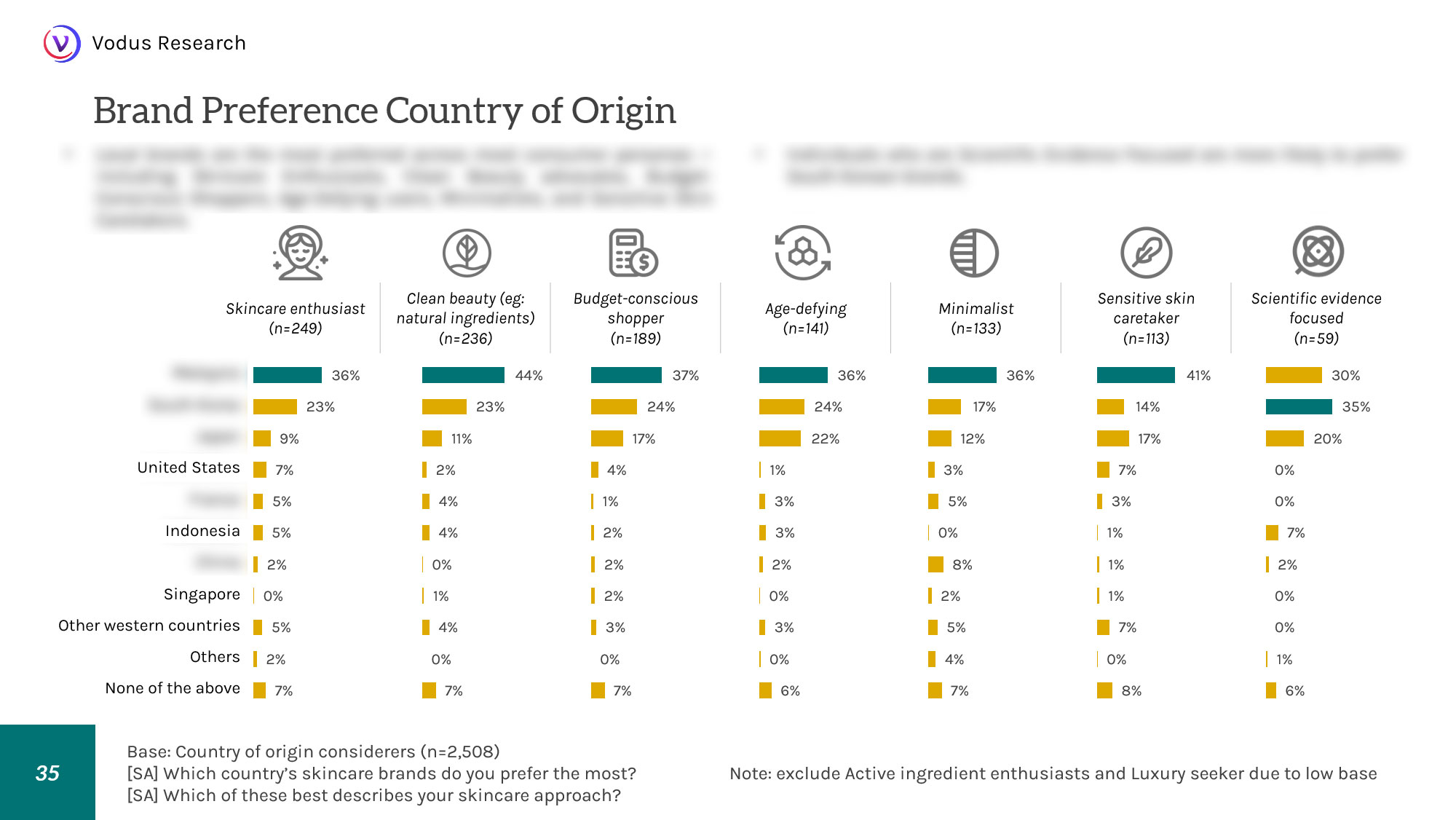

When it comes to skincare brands, Malaysian consumers are both discerning and open-minded. Preferences are shaped not just by nationality, but also by values like trust, affordability, and product performance. While global names from South Korea and Japan enjoy strong cultural appeal, particularly among younger and higher-income consumers, local Malaysian brands are holding their ground and, in many cases, leading.

Local skincare brands are not only widely recognised but also deeply preferred by a large portion of the market. They resonate especially well with consumers looking for authenticity, value for money, and products that feel tailored to local skin concerns. Homegrown labels are performing well among budget-conscious shoppers, minimalists, those with sensitive skin, and clean beauty advocates.

That said, international brands still command strong interest, especially those associated with innovation and proven results. South Korean brands are gaining traction among consumers who prioritise scientific efficacy, while Japanese and French brands carry a sense of premium quality that appeals to a more affluent segment.

Although brands from the United States, France and Singapore are recognised by a smaller group of consumers, they remain relevant in certain high-income niches where global prestige continues to hold sway.

The full Vodus Research report includes a detailed breakdown of brand awareness, consideration and preference by country of origin, along with insights by age group, ethnicity, income level and user persona. Discover how Malaysian brands are performing and where the biggest growth opportunities lie for both local and global players.

What Drives Brand Preference in Skincare

Choosing a skincare brand is more than just visibility or trendiness. For many Malaysian consumers, brand preference is rooted in personal values and lived experience. What works for their skin, fits their budget, and aligns with their expectations. It is not a one-size-fits-all equation.

Local brands have gained strong traction among consumers who want products they can relate to. This includes those seeking affordability, simple formulations, or products that feel culturally or practically relevant. Clean beauty advocates and minimalists often value the simplicity and ingredient transparency offered by many homegrown brands, while sensitive skin users gravitate toward those that understand the realities of Malaysia’s climate and common skin concerns.

Meanwhile, consumers drawn to innovation and results tend to look overseas. South Korean skincare stands out for its association with scientific research, novel ingredients and visible results. These brands appeal to users who actively seek out product information, compare clinical claims, and view skincare as a form of self-investment.

Higher-income Malaysians are also more likely to lean toward global brands including those from Japan, France and the US, where prestige and performance often go hand in hand. For them, skincare may be as much about experience and status as it is about routine.

The full Vodus Research report reveals how brand preference varies not just by nationality but by detailed consumer traits. See how preference shifts across age, income, ethnicity and skincare persona, and which segments local and global brands are truly resonating with.

Which Brands Are Winning Top of Mind and Cart Space

Brand awareness may open the door, but it is what happens after that that truly matters. In today’s skincare market, the ability to convert attention into action and loyalty is what separates standout brands from the rest.

Bio-essence continues to lead the field in top-of-mind awareness, with nearly three-quarters of Malaysian skincare users recognising the brand. Close behind are Skintific and Cetaphil, reflecting strong demand for dermatologist-endorsed and clinically proven skincare. Meanwhile, brands like Hada Labo, Wardah and Glad2Glow have built steady awareness, particularly among women and Gen Y consumers.

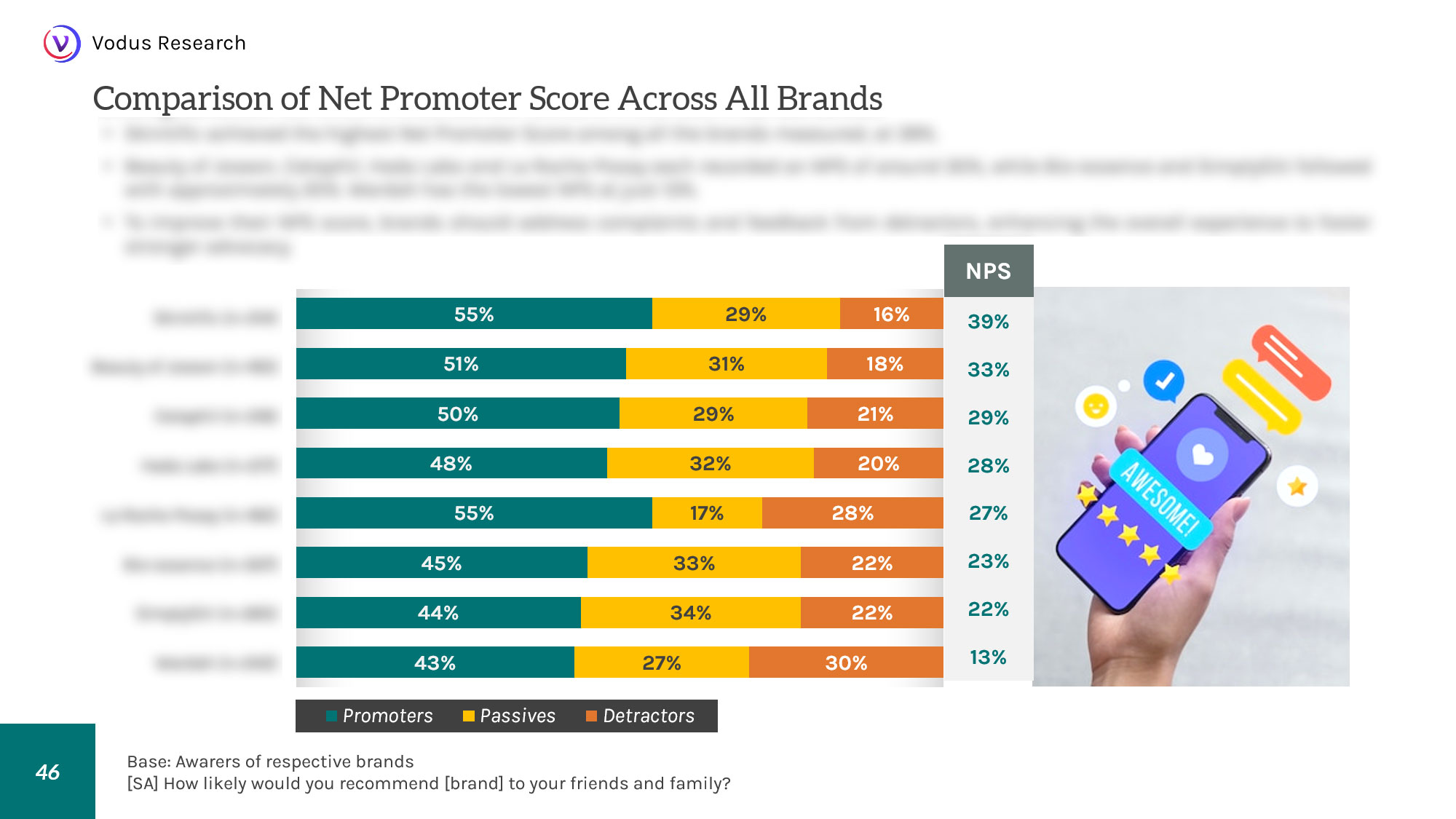

But awareness alone does not guarantee success. Skintific, for example, may have lower awareness than Bio-essence, but it outperforms in converting awareness into active consideration and ultimately, brand preference. Beauty of Joseon also stands out for its ability to generate interest once consumers become familiar with it, suggesting strong brand resonance and appeal.

In terms of purchase conversion, several brands show impressive follow-throughs. Cetaphil, Wardah and Glad2Glow manage to turn nearly every considerer into a buyer. ALIA, on the other hand, demonstrates strength in converting interest into purchases even if its initial awareness remains relatively modest.

Among the most preferred skincare brands overall, Skintific leads among Gen Z, followed closely by Bio-essence and Hada Labo. While other brands like Cetaphil, Beauty of Joseon, ALIA and La Roche-Posay enjoy pockets of loyalty, fewer than one in ten consumers named them as their top choice.

Find out what influences Malaysians choice of shopping channels in https://vodus.com/article/how-malaysians-buy-skincare-mapping-the-path-to-purchase

To view the full performance breakdown including which brands perform best by generation, income group, ethnicity, region and skincare persona, download the full Vodus Research skincare market report.

Key Takeaways and What’s Next

Malaysia’s skincare landscape is evolving in ways that reflect both global influence and local loyalty. While international brands from South Korea and Japan continue to shape consumer expectations through innovation and image, local brands are proving they can compete and, in many cases, led by offering relevance, accessibility and deep cultural resonance.

Consumers are not just choosing skincare based on what is popular. They are influenced by how and where they discover products, what they believe works for their skin and which brands speak to their values. Whether it is awareness, consideration, or preference, each stage of the customer journey offers clues for how brands can position themselves more effectively.

Access the Full Report

The insights shared here are just the surface. The Skincare Market Report Malaysia 2025 breaks down brand awareness, consideration and preference by country of origin and across detailed demographic and psychographic segments including age, ethnicity, income level, region and skincare user persona.

Whether you are a local brand looking to scale or a global player aiming to localise more effectively, the report provides the data you need to build smarter, more targeted strategies in Malaysia’s dynamic skincare market.