May 16, 2025 5:46AM

How Malaysians Choose Milk: Insights from Dairy, Formula, and Plant-Based Consumers

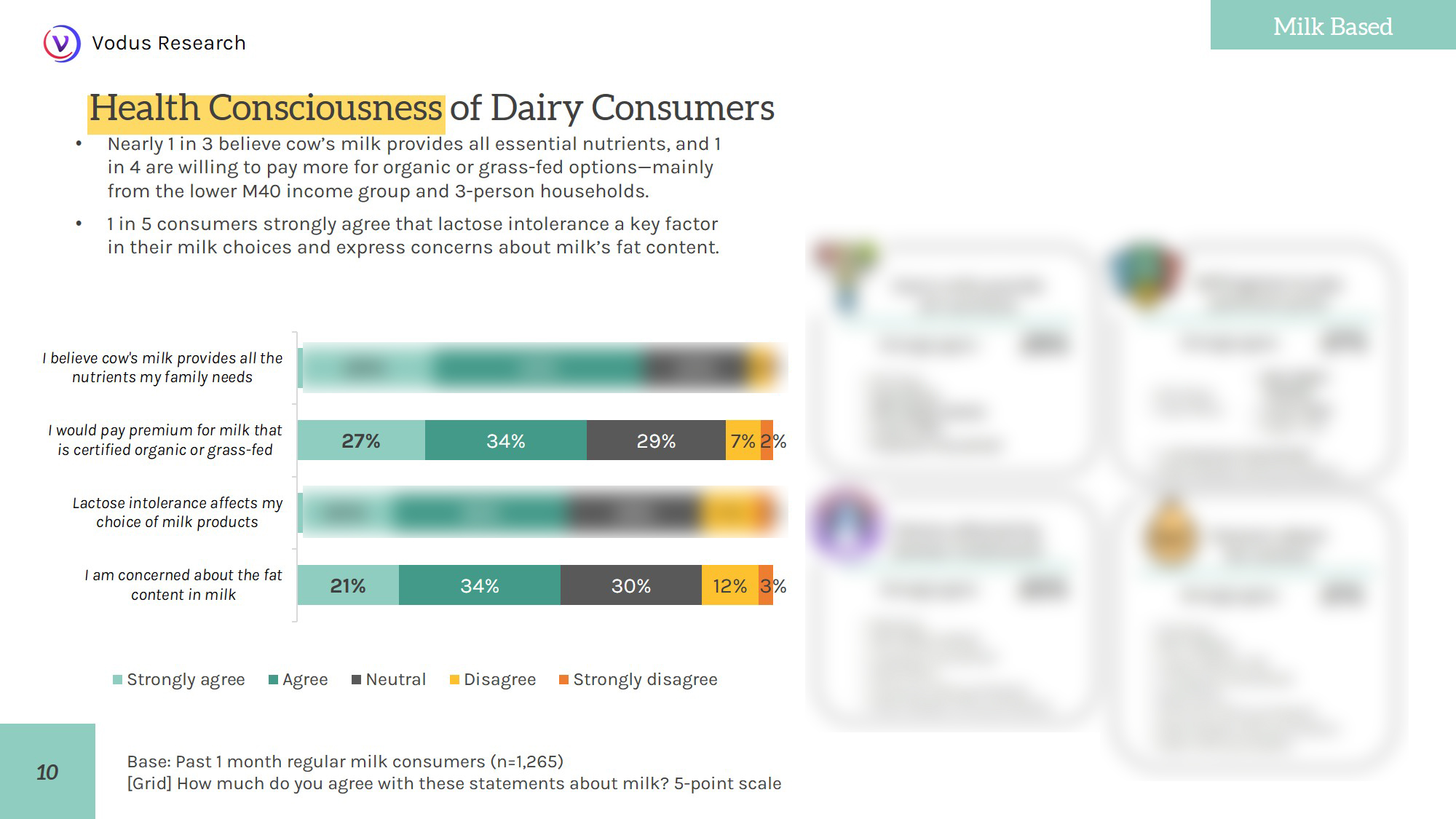

As Malaysians become more health-conscious and the range of milk options keeps growing, people are rethinking what kind of milk they buy. From traditional cow’s milk and formula for kids to newer plant-based alternatives, the milk market here is changing fast. Factors like income, age, household size, and lifestyle all play a part.

Based on our survey findings, we take a closer look at who’s drinking what, and why. By exploring the preferences of three key groups—dairy drinkers, formula buyers, and plant-based consumers—we uncover not just what Malaysians are picking off the shelves, but the reasons behind those choices.

Methodology

Our survey ran from 13 December 2024 to 14 January 2025, using Vodus’ OMTOS online survey method. This gave us access to about 17 million Malaysians across various online platforms—covering more than half the population. We gathered responses from 4,916 people nationwide, giving us a solid snapshot of milk buying habits across the country.

For a detailed breakdown of the survey data and deeper demographic insights, consider purchasing the full report below

What Malaysians Are Drinking: A Snapshot of Milk Choices

Cow’s milk remains the top choice, with nearly half the respondents saying they bought some in the last month. It’s familiar, easy to find, and many trust it as a key part of their family’s diet. Yogurt and yogurt drinks are the next most popular choice, especially among younger consumers who appreciate their convenience and health benefits—38% reported purchasing them in the past month.

Formula milk, mainly for young children, remains important for many parents. Growing-up formulas for toddlers and preschoolers are especially popular. Plant-based milks are smaller in market share but growing steadily. They appeal to urban, health-aware consumers and those with lactose intolerance or other dietary needs.

Goat’s milk and other niche options hold their own for those after specific health benefits. Interestingly, some respondents didn’t buy any milk at all during the survey period. This group might be relying on other nutrition sources or avoiding milk for personal reasons—something brands could investigate more.

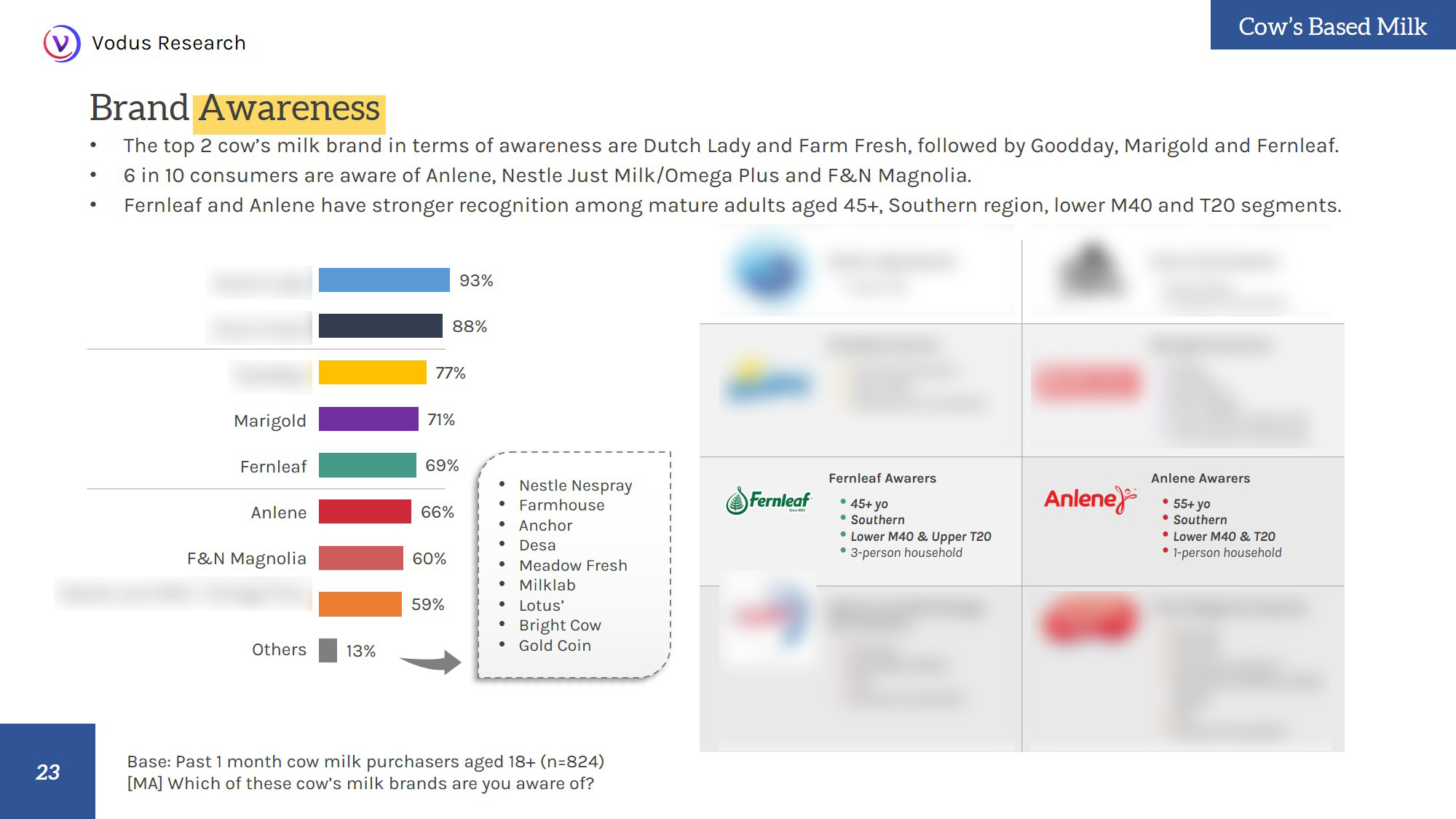

Overall, it’s a diverse market shaped by a mix of tradition, health awareness, and lifestyle choices.

Who’s Buying What? Milk Preferences by Income, Age, and Ethnicity

When we dig a little deeper, it’s clear that different groups of Malaysians have their own milk preferences. People in the M40 income bracket, especially those living in the Central region, tend to buy a bit of everything—dairy, formula, and plant-based milks—making them an important audience for brands to focus on.

Age also shapes choices. Cow’s milk is a favourite among younger adults aged 18 to 24, as well as those in their mid-30s to mid-40s. Yogurt products seem to have broad appeal, especially with people between 18 and 44. Meanwhile, formula and plant-based milks are mostly popular with the 25 to 34 age group—folks who are juggling parenthood and a growing interest in healthier, alternative options.

Ethnicity plays a role too. While yogurt and formula milk are embraced across ethnic lines, cow’s milk and plant-based options are particularly popular among Chinese consumers, which likely reflects cultural preferences and dietary habits.

To explore more detailed consumer segments and regional trends shaping Malaysia’s milk market, the full report offers comprehensive analysis.

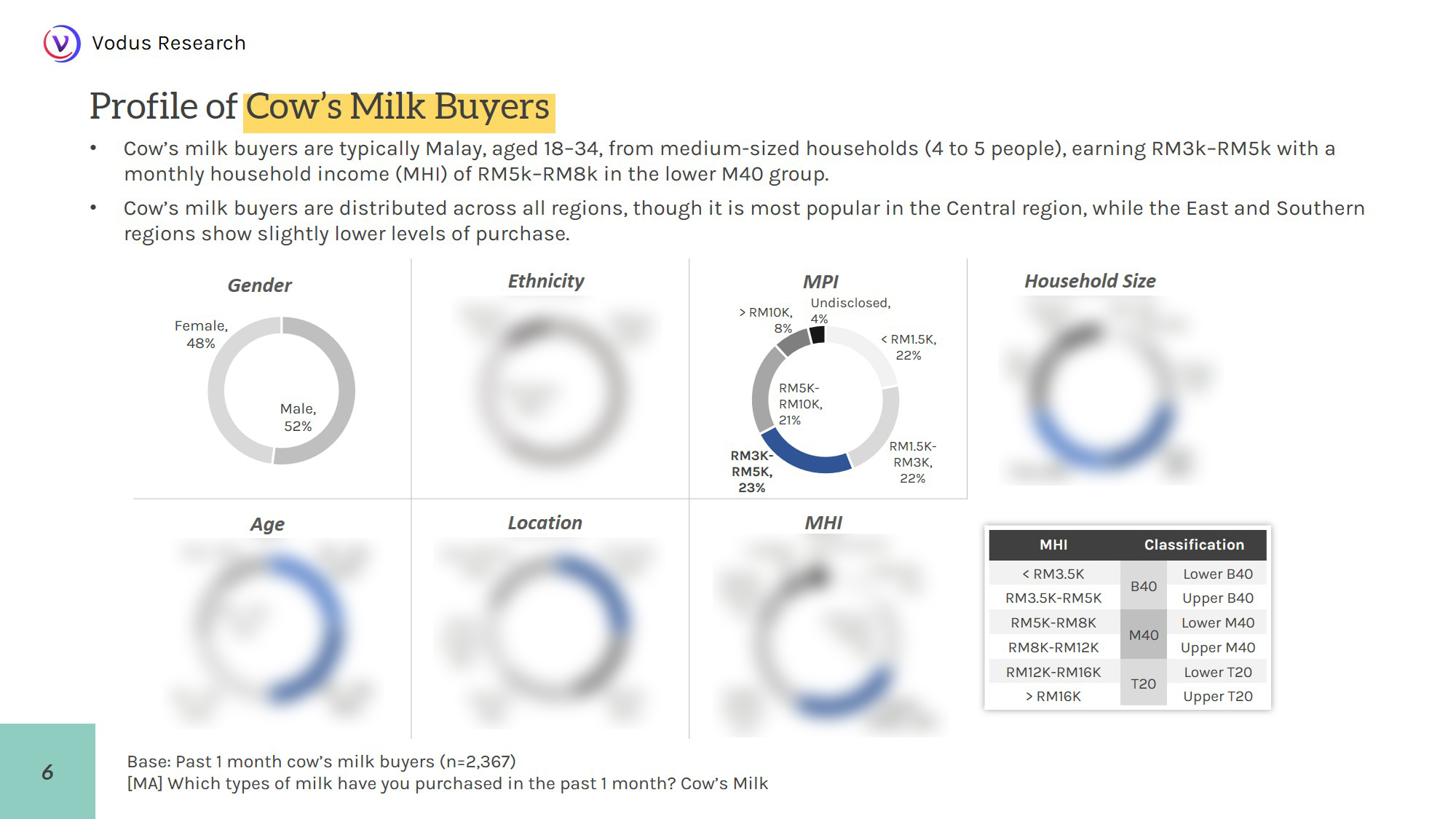

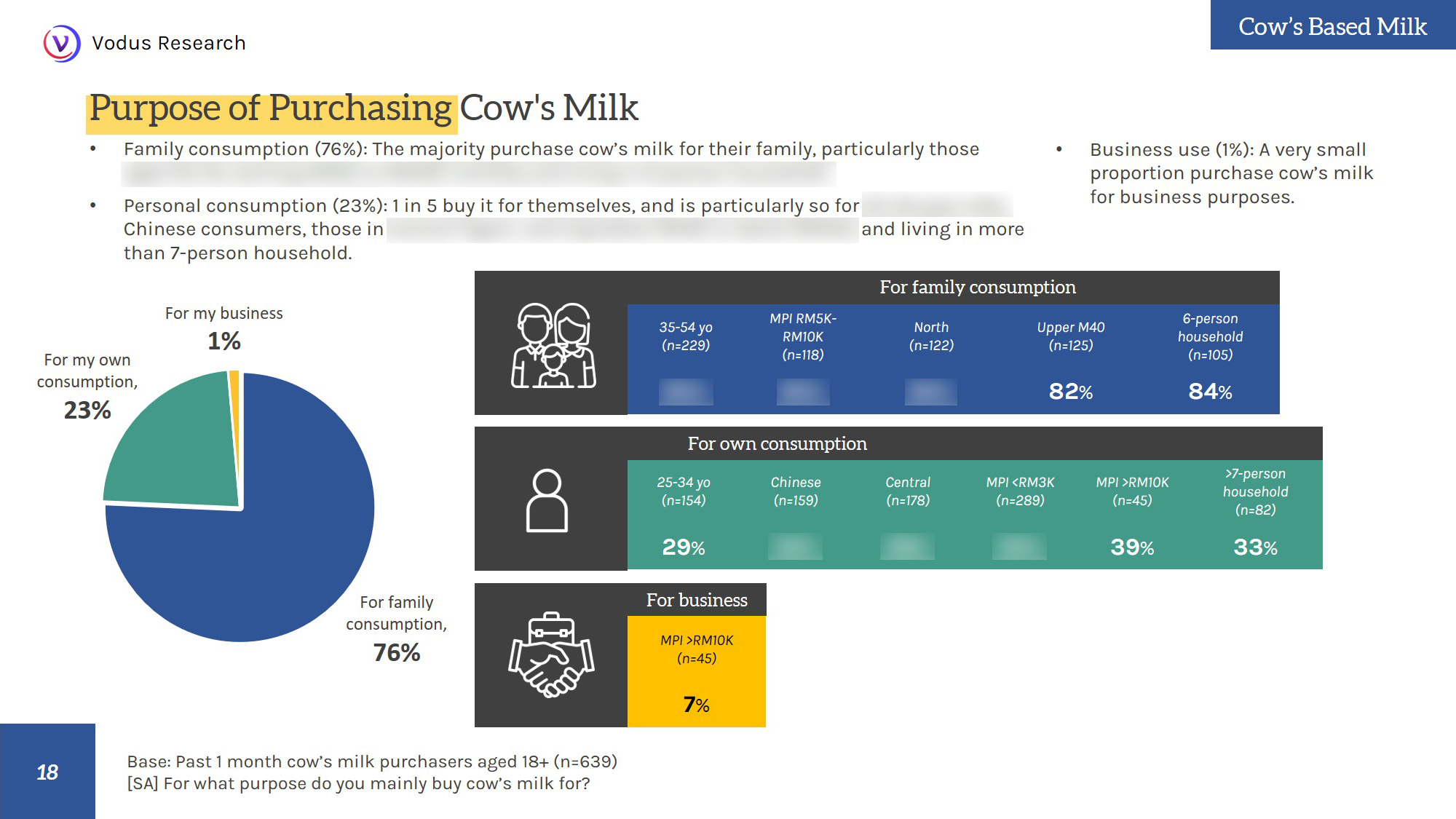

Cow’s Milk Still Rules – Especially Among Young Malay Families

Cow’s milk is a staple in many Malay households, particularly among adults aged 18–34. These buyers often live in households of four to five people and typically fall in the lower M40 income group. They tend to live in the Central region, where cow’s milk purchases are highest. For young families starting out financially, cow’s milk is often seen as affordable and reliable nutrition. Brands can build loyalty here by focusing on accessible pricing and messaging that highlights family health.

Young Urban Males Are Leading the Plant-Based Milk Movement

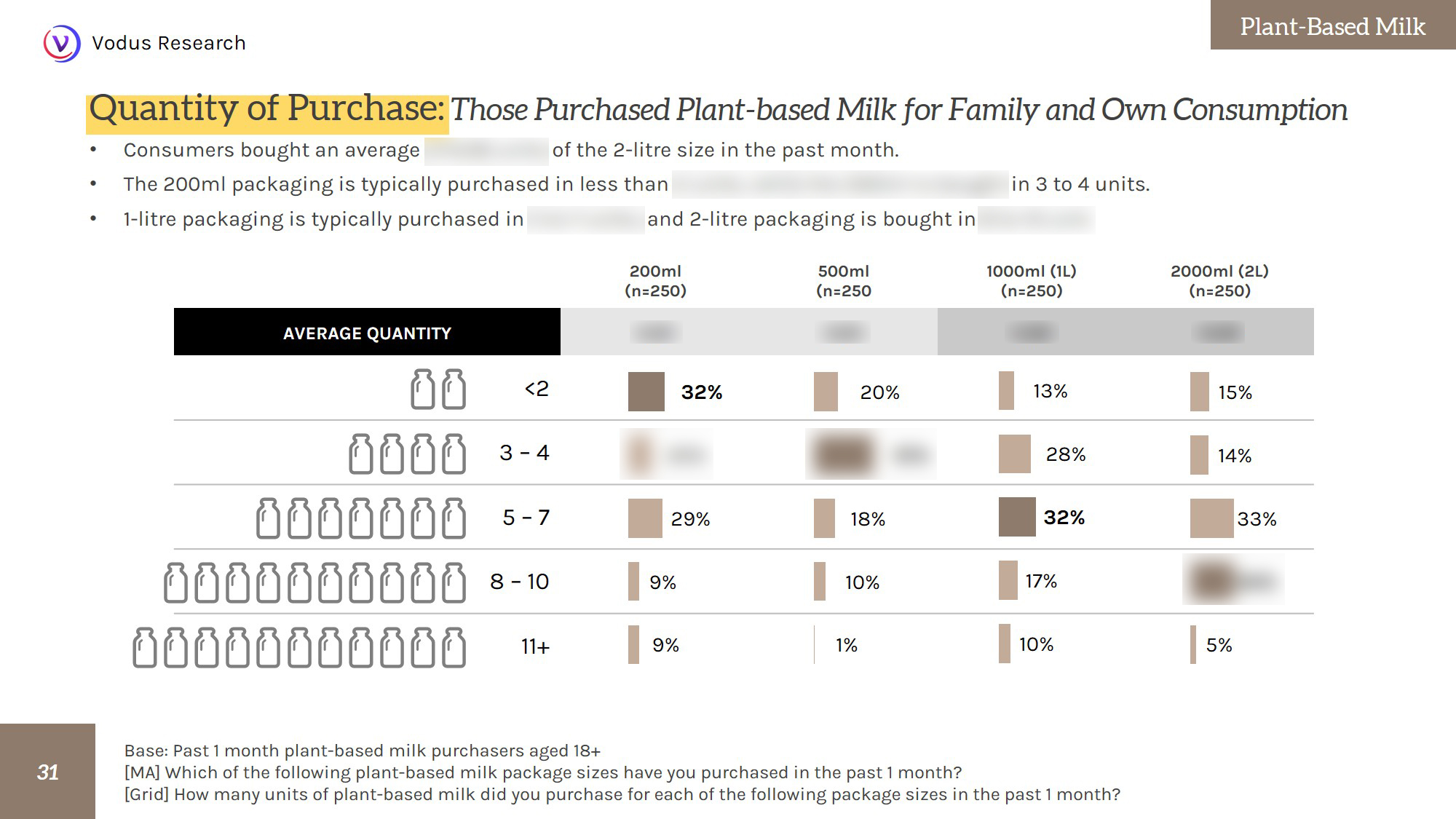

Plant-based milk is gaining traction among a specific group: males aged 25–34 living in urban areas. These consumers typically belong to the middle-income bracket and live in four-person households. Nearly one-third of plant-based milk buyers are based in the Central region, highlighting the influence of urban lifestyles, better product availability, and greater exposure to wellness trends. Health consciousness and curiosity about new food products are key motivators.

This demographic profile suggests that plant-based milk appeals to younger, health-aware men who are open to innovation—offering brands a clear opportunity to promote benefits like sustainability, lactose-free nutrition, and modern lifestyle alignment.

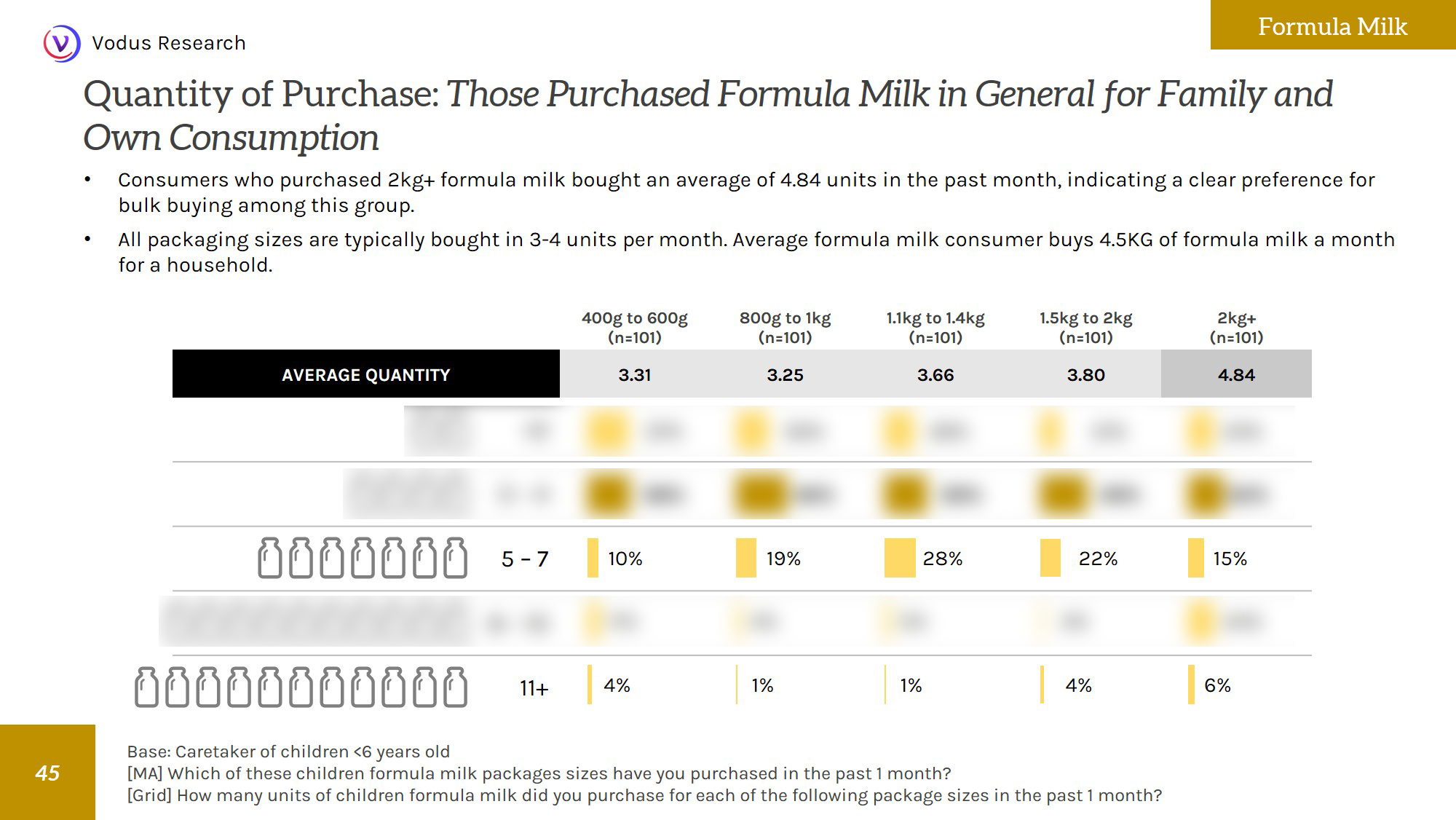

Formula Milk Fuels the Needs of Preschool-Aged Children

Formula milk is mostly bought by Malay fathers aged 25–34 in the Central region. They tend to live in four-person households and are in the lower M40 income bracket.

Among parents with children aged 3 to 6, more than half reported purchasing formula milk. Moreover, 97% said they buy growing-up milk for kids aged 1 to 6. This highlights the important role formula plays in supporting preschool nutrition.

For brands, this means there’s a steady demand for child-focused formula products with messaging around development and nutrition.

To discover which formula milk brands are the most popular among Malaysian parents and gain deeper insights into consumer preferences, download the full market report below.

Why Are Some Malaysians Choosing Alternatives to Cow’s Milk?

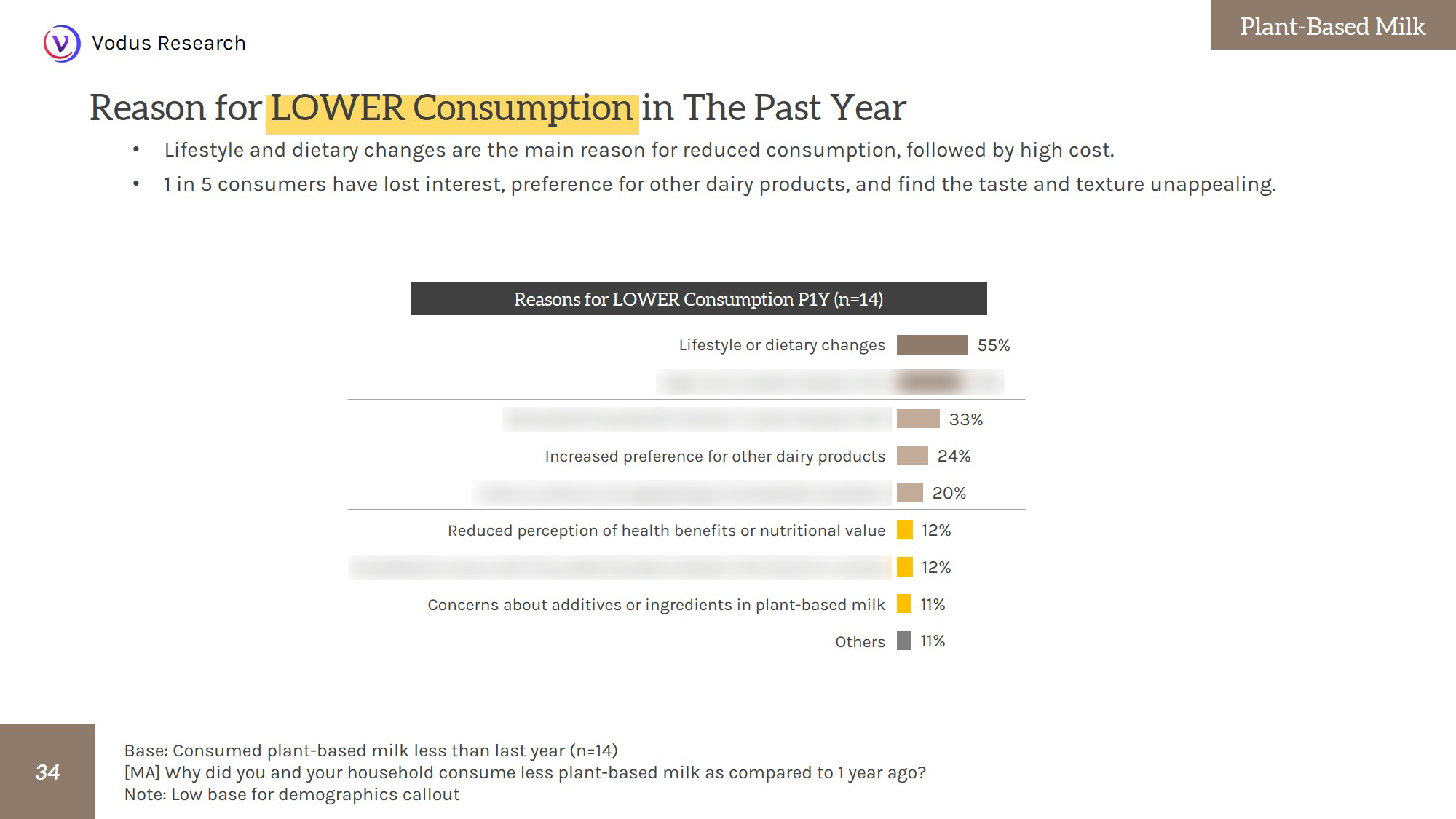

Although cow’s milk still dominates overall consumption, our survey shows that plant-based milk consumers have increased their intake more over the past year—and are more likely to continue doing so in the year ahead—compared to cow’s milk consumers.

Health concerns also influence decisions, with 33% of those who switched away from cow’s milk doing so because of digestive issues like lactose intolerance or milk allergies—especially among women in the Southern region, where these conditions are more commonly reported.

Beyond these, some avoid cow’s milk because of taste preferences or ethical concerns, such as animal welfare and environmental impact, though these reasons tend to affect a smaller segment of consumers.

Overall, Malaysia’s milk market is changing, shaped by tradition but also by health, price, and lifestyle trends. Cow’s milk remains a foundation for many families, especially younger Malay households, while plant-based options are gaining ground with urban health-conscious consumers. Formula milk remains important for young kids, particularly toddlers and preschoolers.

To fully understand these shifting consumer preferences and unlock actionable strategies, purchase the complete survey report today.