May 23, 2023 1:56AM

A Step-by-Step Guide to Conducting Product Innovation Research for Your Business

In today's fast-paced business world, product innovation is essential for companies to remain relevant and successful. Whether it's introducing a brand new product, improving upon existing ones, or adding new features and capabilities, innovation is key to attracting and retaining customers, as well as driving growth and staying ahead of the competition.

Market fit is the key to success for any product innovation. When a product has a good market fit, it means that it meets the needs and desires of its target audience so well that it practically sells itself. This is why achieving market fit is crucial for the success of any product, as it can greatly reduce the need for extensive marketing efforts.

When it comes to product innovation research , there are two main methods: qualitative and quantitative. Qualitative research involves gathering insights and opinions from a smaller group of people through methods such as interviews or focus groups. Quantitative research, on the other hand, involves collecting numerical data from a larger sample size through surveys or experiments. Both methods can provide valuable information for companies looking to innovate their products.

Qualitative Research

Qualitative research in product innovation involves gathering detailed and nuanced information about customers, their preferences, and their behaviors. This approach emphasizes exploring subjective experiences and motivations, rather than relying solely on numerical data. By delving deeper into the thoughts and perceptions of customers, businesses can gain a more comprehensive understanding of how to improve their products or services.

When it comes to product innovation, focus groups are a popular method for qualitative research. These groups consist of a small number of individuals, usually between 6 and 10, who share similar characteristics or experiences related to the product or service being studied. By bringing these individuals together, researchers can gain valuable insights into consumer preferences and behaviors, which can inform the development of new products and services.

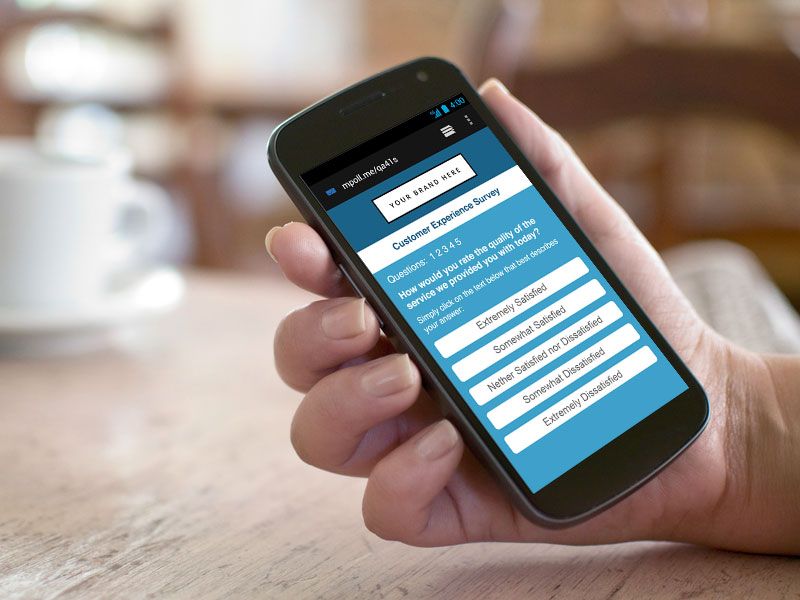

Focus groups are a valuable tool for gathering insights from a small group of consumers. By discussing their pain points, purchase drivers, brand preferences, and perceptions, you can gain a holistic view of their perspective and use this information to establish your initial product concept or hypothesis. However, it's important to validate your hypothesis through quantitative research. To do this, you can use the insights from your qualitative research to develop a survey questionnaire, including key points as answer choices in multiple choice questions (MCQs). This will help you gather quantitative data to support your product concept.

Quantitative Research

Quantitative Step 1 - Usage & Attitudes

Gaining a thorough understanding of how consumers use and perceive your product is crucial. This entails knowing the specific instances, locations, and motivations behind their product usage. By identifying the pain points and purchase drivers within your product category, you can develop a deeper comprehension of how your product fulfills the needs and desires of your target audience. This knowledge provides valuable insights for refining your product strategy and ensuring that it aligns effectively with consumer expectations.

Quantitative Step 2 – Product Concept Test

To gather feedback from consumers, begin by providing a concise description of your product concept and request their input. Inquire about their level of interest in using or purchasing the product, as well as the price point at which they would be willing to do so. This feedback serves as a valuable resource for refining your product concept and ensuring that it aligns with the needs and desires of your target audience. By actively engaging with consumers and incorporating their insights, you can enhance the development process and increase the likelihood of a successful product launch.

To assess the potential success of your product idea, gaining insights into the price sensitivity of your target market is crucial. One effective approach is to utilize the Price Sensitivity Meter (PSM) to gauge consumer reactions to various price points. This analysis will help you understand how price impacts their purchasing decisions. Additionally, segmenting your consumers based on their likelihood to purchase allows you to identify the most promising group to target initially. This segment, often referred to as the "low-hanging fruit," consists of individuals with a high propensity to buy your product, making them an ideal focus for your marketing efforts. By considering price sensitivity and strategically targeting receptive consumers, you can optimize your product's market potential.

Analysing insights is critical in the process of refining and finalizing a product concept. By giving priority to the insights obtained from surveys such as U&A and Product Concept Tests, valuable information can be gleaned. This information serves as a foundation for creating a product sample or minimum viable product (MVP) to drive further development.

Quantitative Step 3 – Use Test

After creating a product sample, it is essential to involve consumers in testing the minimum viable product (MVP). This testing phase encompasses various metrics, including propensity to buy and PSM (Perceived Satisfaction Measures), similar to the Product Concept Test. However, the Use Test takes the evaluation process a step further by allowing users to experience the product firsthand instead of merely visualizing it. This hands-on experience makes the Use Test a pivotal step in the overall product development process.

Use Test serves as a valuable tool for gathering feedback on different attributes of a product, such as its scent, taste, texture, and effectiveness. It enables consumers to provide their own feedback on the product's performance based on their firsthand experience. By engaging users in this type of testing, valuable insights can be obtained, helping to refine and enhance the product based on consumer preferences and satisfaction.

There are two main types of Use Tests: Central Location Tests (CLTs) and Home Use Tests (HUTs). Both methods provide valuable insights into how consumers interact with and perceive a product.

CLT (Central Location Test)

CLT involves renting a centralized location, often in a city center, and inviting participants to test the product on-site. It is particularly suitable for products that require freshness, like food and beverages, or those that are costly to produce in large quantities, such as consumer electronics. Conducting the test in a controlled environment allows researchers to closely monitor product consumption and gather more feedback in a more structured way. However, CLTs can be more expensive compared to other testing methods like HUTs . Additionally, the sample size may be limited to consumers in larger cities, potentially introducing sampling bias.

HUT (Home Use Test)

The Home Use Test (HUT) is a product testing method where participants are recruited online or through a panel and receive product samples delivered to their homes. This approach is suitable for packaged products like fast-moving consumer goods (FMCG) and beauty products, as well as intangible products like software that can be used online. Participants are responsible for preparing the product themselves and using it in their normal routine. The advantage of this method is that participants can test the product at their convenience and in the comfort of their own homes, providing a more authentic and natural usage experience. Moreover, the HUT is a cost-effective alternative to the CLT and allows for a broader geographic representation of participants.

Ideally, product innovation research should encompass all three steps mentioned above. However, budget constraints may limit businesses from conducting all of them. In such cases, businesses can prioritize and perform the necessary steps based on their resources. If a U&A study has already been conducted to understand consumers, the business can proceed directly to the Product Concept Test and Use Test. Alternatively, if the budget does not allow for a Use Test, focusing on the Product Concept Test can still provide valuable insights.

These steps are vital in ensuring that the product aligns with the needs and preferences of the target market.

How Can Vodus Research Help You With Product Innovation Research

Vodus Research is a reputable provider of product innovation research services, specializing in assisting major brands in confidently launching innovative products. Our Vodus Product Innovation Research Solutions are tailored to deliver the essential insights necessary for optimizing your product and ensuring a successful launch. With our expertise, you can navigate the complexities of the market and make informed decisions to drive the success of your product innovation endeavors.

Leveraging our Vodus Media Network, we have the capability to draw nationally representative samples that precisely mirror your target market. This approach enables us to gather highly accurate insights into consumer preferences and behaviors, empowering you to make data-driven decisions. By partnering with us, you can stay ahead of the competition and confidently bring innovative products to the market, knowing that your strategies are rooted in comprehensive and reliable research.