May 22, 2025 4:04AM

The Rise of Plant-Based Milk: What's Driving the Shift in Malaysia?

As more Malaysians reevaluate their dietary choices, plant-based milk has emerged as a fast-growing segment in the broader milk category. Once considered a niche product, it is now making its way into mainstream kitchens across the country. From health-conscious millennials to large multigenerational households, the appeal of dairy alternatives is growing steadily.

Our survey ran from 13 December 2024 to 14 January 2025, using Vodus’ OMTOS online survey method. This gave us access to about 17 million Malaysians across various online platforms—covering more than half the population. We gathered responses from 4,916 people nationwide, giving us a solid snapshot of milk buying habits across the country.

Want the full picture? Our complete market report offers detailed consumer breakdowns by age, region, income tier, and purchase frequency—available now

Who Is Buying Plant-Based Milk in Malaysia and Why?

The demographic profile of plant-based milk consumers in Malaysia reveals a predominantly younger, urban population that is increasingly proactive about health and wellness. Adoption is particularly strong among individuals aged 25 to 34, a group known for its openness to dietary experimentation, alternative nutrition, and lifestyle trends that promote sustainability and wellbeing.

However, the appeal of plant-based milk is far from limited to young adults. Family-oriented buyers—especially those in the middle-income and upper-income brackets—are also showing growing interest. For many, this choice is motivated by concerns over long-term health and nutrition, particularly when it comes to the dietary needs of children and elderly family members. Plant-based milk offers a versatile and often allergen-friendly alternative that suits a variety of household needs.

Moreover, larger households, with five or more members, tend to be more inclined to explore a wider range of plant-based options. This is likely influenced by a desire for flavour variety, convenience, and the ability to accommodate diverse health considerations within the family. For these consumers, plant-based milk isn’t just a niche product but an integral part of daily nutrition and meal planning.

Additionally, regional trends suggest that interest is growing not only in urban centers like Kuala Lumpur and the Klang Valley but also in East Malaysia, where consumer preferences and availability are evolving. These dynamics highlight a broadening market with opportunities for brands to tailor their offerings to distinct demographic and geographic segments.

Looking to tap into the most active consumer segments? Our report includes full demographic charts with detailed motivations and buying contexts.

Popular Types of Plant-Based Milk and Packaging Preferences Among Malaysians

When it comes to variety, classic plant-based milk options like soya milk continue to hold the top spot, deeply rooted in Malaysian dietary habits and cultural familiarity. Alongside soya, oat milk and almond milk have surged in popularity, driven by growing awareness of their perceived health benefits, smooth texture, and versatility.

Beyond these staples, more adventurous consumers—particularly those aged 45 and above, as well as those in East Malaysia—are exploring emerging formulations such as such as banana and date flavoured milk. This openness to innovation signals a dynamic and evolving market that welcomes novel flavours and formulations tailored to local tastes.

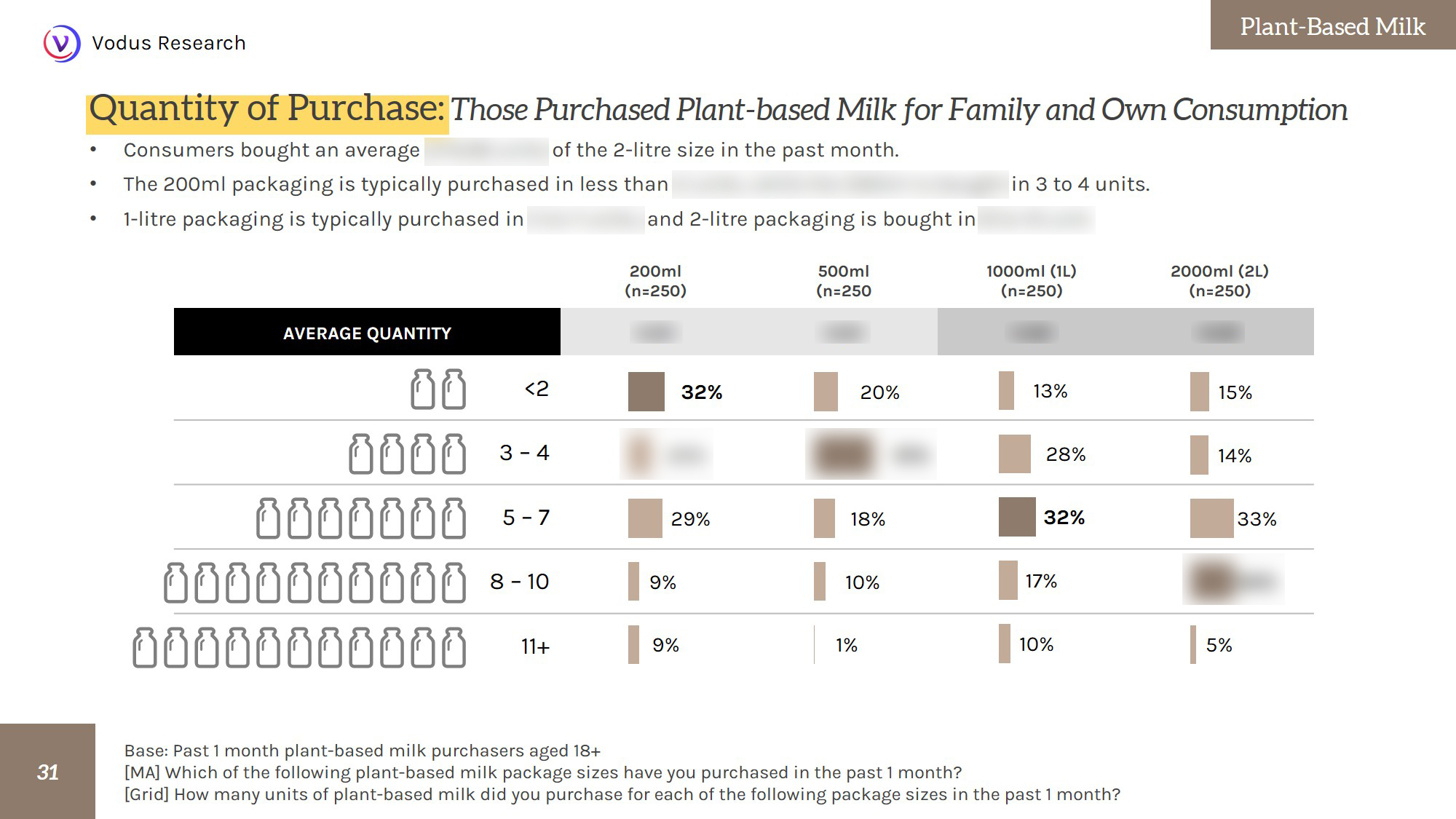

Packaging preferences offer another window into consumer behaviour. The 1-litre packaging size is the most popular format, especially among middle-aged buyers in larger families, balancing convenience and value for regular consumption. In contrast, smaller packaging sizes such as 200ml and 500ml strongly appeal to coconut milk and other plant-based milk purchasers.

This diversity in product and packaging sizes highlights a category that caters to a broad spectrum of lifestyles and consumption occasions—from quick breakfasts and coffee accompaniments to cooking and health-focused meal planning.

Want to know which pack sizes are purchased most frequently and by whom? Our full report includes household-level insights, monthly consumption estimates, and segment-specific pack preferences.

The Growing Popularity of Plant-Based Milk in Malaysia

Plant-based milk is no longer an occasional purchase—it’s fast becoming a staple in Malaysian households. A notable portion of consumers reported increasing their intake over the past year, with many anticipating further growth in the months ahead. This positive momentum reflects not just trial and experimentation, but a deepening integration of plant-based options into everyday routines—from breakfast tables to cooking and snacking.

This trend is especially strong among female consumers and those living in Central and Southern Malaysia, who are more likely to expect their consumption of plant-based milk to increase over the next year.

Nearly half of consumers expect their plant-based milk consumption to stay the same—and their sentiment remains positive. This suggests it’s already a regular part of their diet, not just a passing trend.

Curious about how fast the category is growing—and which segments are driving the momentum? Access our forecast and year-over-year consumption trend analysis in the full report.

Malaysia’s Plant-Based Milk Brand Landscape: Leaders and Growth Opportunities

The plant-based milk space in Malaysia is rapidly evolving, with a mix of established local brands and emerging international names competing for consumer attention. A few standout players have successfully built strong reputations through consistent quality, smart positioning, and wide availability.

Farm Fresh’s plant-based range, for example, has demonstrated exceptional performance in converting brand awareness into consumer preference—reflecting high trust and relevance among Malaysian buyers. Meanwhile, brands like V-Soy have maintained strong market presence, especially among older and mid-income consumers who value familiarity and affordability.

On the other hand, international oat milk brands such as Oatside and Oatly are gaining traction among younger, urban consumers, particularly within mid- to upper-income households. These brands are carving out a niche through sleek branding, perceived health benefits, and modern taste profiles.

Interestingly, preferences differ by household size and income bracket. For instance, almond milk options like 137 Degrees show notable appeal among older, health-conscious consumers, while younger Malaysians tend to favour trendier blends or explore emerging varieties.

Despite the competitive landscape, there’s still room for improvement. Some brands with high awareness have yet to fully translate visibility into loyalty—pointing to opportunities for better differentiation, stronger messaging, or expanded flavour portfolios.

Which brands lead in conversion, and where are the growth opportunities? The full report breaks down brand performance by income group, age, household size, and more.

What’s Holding Some Consumers Back

Despite growing interest and rising consumption, plant-based milk still faces several hurdles to wider adoption in Malaysia.

Many consumers continue to prefer traditional cow’s milk, often citing familiarity, flavour, and perceived nutritional superiority. In fact, preference for cow’s milk was the top reason consumers gave for not drinking plant-based milk regularly.

Others are open to trying plant-based options but remain hesitant due to limited exposure or uncertainty about the benefits. According to our survey, lack of familiarity ranked as the second most common barrier—indicating that education and sampling still have an important role to play.

Other key concerns include:

- High cost is a common concern, cited by 26% of consumers, mostly among those living in households of four people.

- Additives and ingredients – Consumers expressed caution around added sugars and preservatives, particularly in flavoured variants.

- Taste and texture – Around 1 in 10 respondents said they dislike the taste or mouthfeel of plant-based milk.

- Nutritional value – A similar proportion felt that plant-based options lacked sufficient nutrition, particularly for children or the elderly.

- Allergies and sensitivities – A smaller group avoided plant-based milk due to dietary restrictions involving soy, nuts, or grains.

Want to understand the top reasons for resistance—and how to address them? Our full market study details the most cited consumer concerns and how they vary by demographic.

Future Trends and Opportunities for Plant-Based Milk Brands in Malaysia

The growing demand for plant-based milk in Malaysia is not a passing trend—it signals a deeper shift in consumer priorities. Increasingly, Malaysians are choosing products that align with values like personal health, family wellbeing, and environmental responsibility.

For brands, this presents an opportunity not just to compete on price or taste, but to speak to lifestyle aspirations. Whether it's supporting digestion, offering allergen-friendly options, or catering to vegan and flexitarian diets, brands that can communicate clear functional and emotional benefits will have an edge.

There is also a growing need to:

- Tailor offerings to household types and regional preferences. For instance, large households (6+ people) are more likely to purchase larger pack sizes and explore flavour variety.

- Address gaps in education and product knowledge. Many consumers remain unsure about the nutritional profile of plant-based milk or how it compares to cow’s milk. Clear labelling, transparent ingredient lists, and health certifications could help build trust.

Meanwhile, health professionals, educators, and sustainability advocates have a critical role to play. Whether through community campaigns, nutritional guidance, or public education, they can help close the knowledge gap and empower Malaysians to make confident, informed decisions about plant-based milk.