May 28, 2025 11:18AM

How Malaysian Households Choose Formula Milk: Price, Brand, or Nutrition?

Formula milk remains a vital part of child nutrition for many Malaysian families, particularly as children transition from infancy through early childhood. Recent research conducted by Vodus Research sheds light on the diverse factors shaping formula milk purchasing decisions across the country. Understanding these drivers, whether they be price sensitivity, brand loyalty, or nutritional considerations, is essential for brands looking to capture and retain this important market segment.

Methodology

Our survey ran from 13 December 2024 to 14 January 2025, using Vodus’ OMTOS online survey method. This gave us access to approximately 17 million Malaysians across various online platforms, covering more than half the population. We gathered responses from 4,916 adults nationwide, providing a robust snapshot of milk purchasing habits across Peninsular and East Malaysia, including urban and rural areas.

Who Buys Formula Milk?

Our study reveals that formula milk purchasers are most commonly Malay males in their mid-20s to early 30s, mainly residing in Central Malaysia. These buyers typically come from middle-income households and belong to medium-sized families. This demographic profile suggests that young families balancing budgets and nutritional priorities make up a significant share of the formula milk market.

One notable finding is the strong male presence among formula milk purchasers. While decisions around child nutrition are often associated with mothers, the data shows that men—particularly Malay fathers—are playing a more active role in household buying decisions. This may reflect shifting family dynamics, with fathers becoming more involved in childcare responsibilities or household budgeting, especially in dual-income households.

When examining consumption by child age, formula milk is most commonly purchased for children aged 3 to 6 years, highlighting the importance of growing-up milk as a staple in early childhood nutrition. A large portion of parents also invest in growing-up milk products targeted at children between 1 and 6 years, reflecting ongoing nutritional needs beyond infancy. While infant formula for babies under one year is less frequently purchased, it remains a crucial product segment, underscoring its role in early-stage child development and feeding routines.

Understanding these buyer profiles helps brands tailor their product offerings and marketing strategies to better meet the specific needs of young families who are both cost-conscious and keen on ensuring proper nutrition for their children.

Want to see how formula milk consumption differs by household type, region, or child age? Access the full report for detailed segmentation insights.

Price Matters: The Power of Promotions and Affordability

Our research highlights just how much price and promotions shape formula milk purchasing decisions. Nearly 2 in 5 milk consumers say they are more likely to pick brands that offer discounts or special deals—and this tendency is even stronger among formula milk buyers. These value-conscious shoppers respond well to pricing incentives, which means well-timed promotions can play a crucial role in encouraging brand switching and boosting customer loyalty.

When it comes to affordability, lower-priced formula milk brands clearly lead the market, especially among younger consumers aged 18 to 24, lower-income households, and those living in southern Malaysia. On the other hand, premium formula milk brands find favor primarily with Chinese consumers who tend to be in higher income brackets and live in smaller households. This split reveals distinct market segments shaped by both socio-economic status and demographic factors, offering brands clear opportunities for targeted marketing strategies.

Packaging Preferences: Size and Convenience

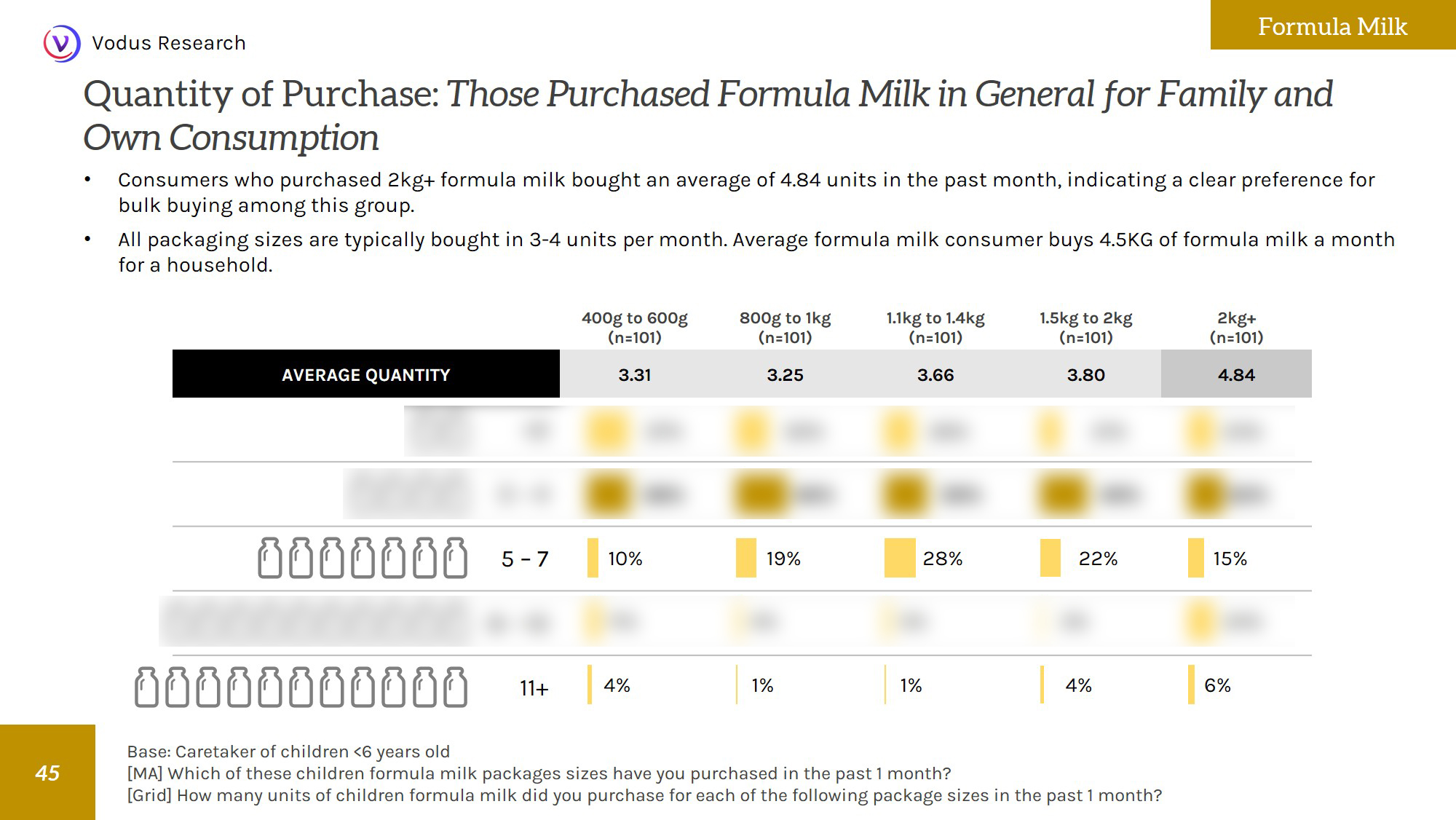

Packaging size preferences vary considerably across consumer segments. Younger parents and Chinese consumers aged 35 to 44 tend to prefer smaller formula milk packages ranging from 400 grams to 600 grams, likely driven by budget considerations, storage limitations, or concerns about freshness. Larger package sizes of 2 kilograms or more are less common but tend to be favored by households in East Malaysia, particularly those from lower-income segments.

Understanding these preferences is critical for brands to tailor packaging formats that meet the practical needs of different households and encourage repeat purchases.

Discover detailed segmentation of packaging preferences in the full Vodus Research report.

Timing Is Everything: Understanding Consumption Patterns for Strategic Impact

Formula milk consumption among Malaysian households follows distinct daily rhythms, with notable peaks during early mornings and at bedtime. These times are when parents most rely on formula milk to support their child’s nutrition and maintain feeding routines.

Parents with infants exhibit additional feeding peaks in the afternoon and evening, highlighting the increased nutritional demands during infancy. This variation in feeding frequency reflects the evolving needs of children as they grow, and the central role formula milk plays in meeting these demands.

For brands, these consumption patterns offer strategic opportunities. Marketing efforts and promotions aligned with these key times can better engage caregivers. Additionally, innovations such as convenient packaging or ready-to-serve options can address the practical challenges of multiple daily feedings.

Want to dive deeper into consumption timing by demographic? Get the full report now.

Brand Awareness and Loyalty: Navigating Market Leaders and Opportunities

In Malaysia’s formula milk landscape, Dutch Lady stands out as the most recognized and trusted brand, especially among lower-income households. This strong presence is not only a result of its long-standing market heritage but also a reflection of consistent, mass-market-oriented marketing and pricing strategies that reinforce brand familiarity and encourage loyalty over time. Its ability to maintain high recall and repeat purchases suggests that Dutch Lady has successfully embedded itself as a default choice for many budget-conscious families.

Farm Fresh, while newer in the formula space, emerges as a strong challenger brand, demonstrating consistent traction across the entire consumer journey — from initial awareness to post-purchase loyalty. Its steady performance indicates a balanced brand strategy that resonates with modern, possibly more health-conscious consumers.

Enfagrow and Enfalac, though not always top-of-mind in initial consideration, excel in converting trial into loyalty. This suggests that product experience — particularly perceived nutritional value or efficacy — plays a key role in building trust among their users. Their performance illustrates the power of product satisfaction as a loyalty driver, even when upfront visibility may be more limited.

In contrast, Sustagen struggles to bridge the gap between brand awareness and active engagement. While it may benefit from residual familiarity, it appears to lack a compelling hook or differentiation point that motivates purchase or fosters repeat use. This gap underscores a need for sharper positioning, refreshed messaging, or stronger emotional appeal to regain traction.

Similac shows promising traction among middle-income households, with brand appeal that may be tied to specific nutritional claims, medical endorsements, or targeted demographic messaging. However, its niche resonance suggests an opportunity to broaden relevance across segments without diluting brand identity.

Notably, many consumers express a willingness to purchase Dutch Lady, Enfagrow, or Enfalac in the future, reaffirming the value of both brand familiarity and positive product experience. These intentions highlight a critical opportunity: brands that can maintain strong recall while continuously validating their product promise stand to deepen their market reach and strengthen long-term consumer loyalty.

Our Malaysia's Drinking Milk Consumer Report 2024 covers a wide range of formula milk brands available in the Malaysian market, providing insights into consumer perceptions and behaviours for each. These include Dutch Lady, Fern Leaf, Dumex (including Dugro and Dupro), Farm Fresh formula milk, Enfagrow, Enfalac, Sustagen, S-26, Aptamil, PediaSure, Friso and Frisolac, Nestlé Lactogen, and Similac. By examining how these brands perform across the stages of awareness, consideration, and loyalty, the findings offer a comprehensive view of Malaysia’s dynamic formula milk landscape.

Explore brand-specific insights and consumer perceptions further by accessing the complete report.

Consumption Trends: Shifting Behaviors and Future Outlook

Formula milk consumption in Malaysia has generally increased over the past year, particularly among younger parents and households with infants and toddlers. This growth may be influenced by increasing awareness of nutritional benefits as well as evolving lifestyle factors such as urbanization and dual-income families.

Looking forward, a significant portion of consumers plan to sustain or raise their formula milk usage, with specific ethnic groups and household sizes showing particularly strong intent. Formula milk consumption declines as children transition to solid foods or switch to other dairy products, reflecting changing nutritional needs and preferences among parents."

For manufacturers and retailers, these evolving trends emphasize the importance of targeted marketing and product innovation. Brands that align their offerings with the nutritional needs and lifestyle realities of diverse consumer segments will be better positioned to capture emerging opportunities and remain competitive.

Interested in understanding the full scope of changing consumption patterns and consumer intentions? Access the complete Vodus Research report today.